(Private Banker International) - Analysing the trend in profits and expenses at major international banks with substantial wealth management divisions points to a big increase in technology investment in 2023.

Inflation, poor financial markets driven by recessionary fears, and delayed technology spending during the pandemic all argue for a big increase in technology-related spending. Wealth manger tech spend is definitely set to be key.

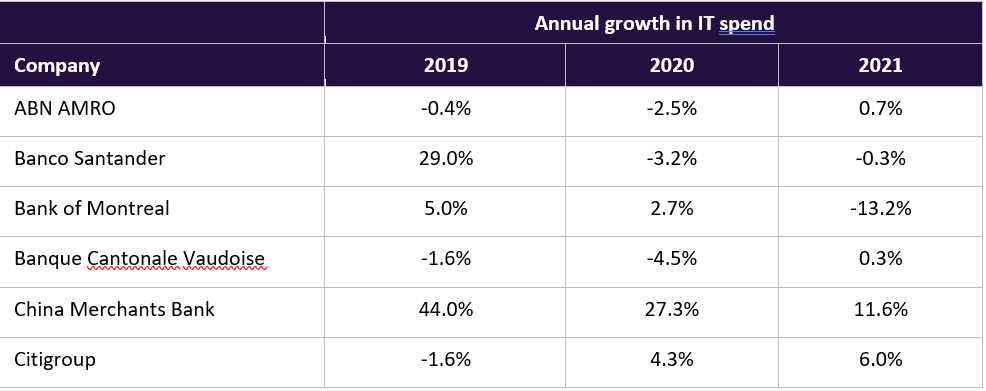

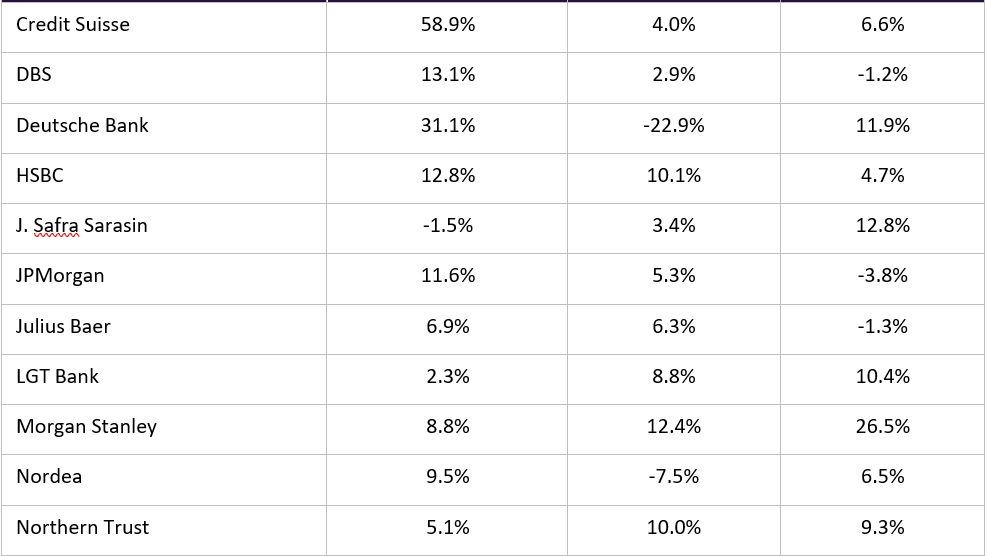

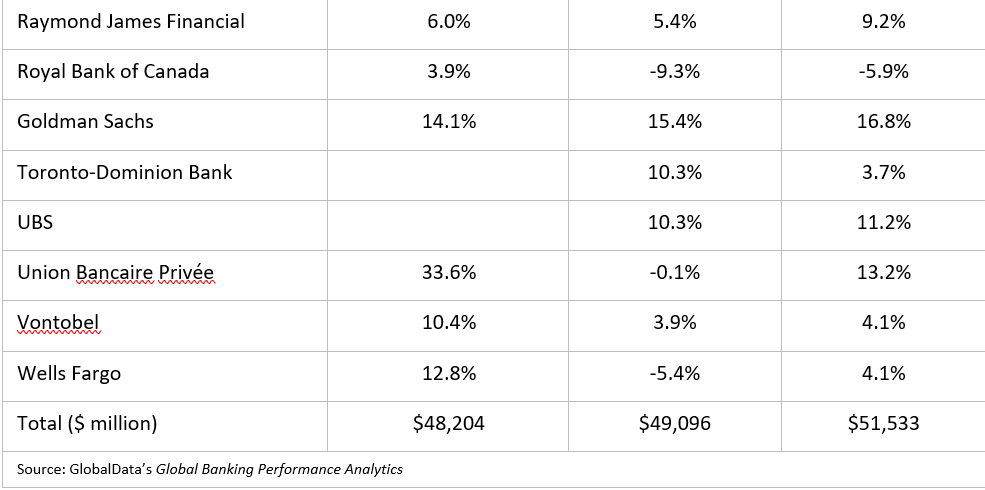

GlobalData has compiled the group technology spend of major banking groups over the COVID-19 period, and despite higher operating costs due to the pandemic, the actual amount of spending on IT-related costs by the 25 largest wealth managers only rose by 6.9% over 2019–21. This did amount to more than $50bn in IT-related spend at just these 25 banks, a first for the industry, but it is still a relatively tame increase for a two-year period, considering the same banks averaged 11.5% growth in the two years prior to the pandemic. While the pandemic spurred a big shift towards digital across banking and wealth management, big and expensive IT projects were also very clearly put off in favor of this crisis spending.

With 2022 turning into the wealth management industry’s ‘annus horribilis’ amid a major war in Europe, rolling lockdowns in China, double-digit inflation, sharp interest rate rises around the world, cratering financial markets, and the prospect of recession, wealth management profits are diving after reaching all-time highs in 2021. And with many of these issues extending out into 2023, prospects for a quick rebound next year seem fanciful.

So with the growth revenue likely to be poor in 2023 and inflation providing sustained pressure on the cost line, wealth managers will rediscover their zeal for structural improvements in efficiency. And that means big investments in technology upgrades and increased digitalisation. With the low-hanging fruit long since addressed by these leading banking groups, this will, unfortunately, require big spending. But with private bank executives under pressure after 2022’s poor figures, the promise of long-term improvement in cost to serve and efficiency gains will likely win over boards eager to safeguard a division that has shown itself able to generate attractive profits like it did during 2021. Expect to see a return to double-digit IT spending growth.

GlobalDataFinancialServices

December 12, 2022