Almost All Programs at Minority-Serving Institutions Would Pass Gainful Employment

The for-profit sector is a different story

Blog Post

Illustration by Fabio Murgia from Shutterstock images

April 25, 2023

The Department of Education released updated GE data in May 2023. See our latest blog for a similar analysis using the updated data.

More than a decade ago, the Obama administration proposed cutting off federal financial aid to short-term and for-profit college programs whose graduates consistently struggle to find gainful employment. Sensing an existential threat to their business models, for-profit colleges fought back. Their lawsuits ultimately could not stop the regulations from going into effect. But lobbying proved successful with the Trump administration, which rescinded the regulations before they were fully implemented. Now, the Biden administration is preparing to reintroduce and strengthen gainful employment regulations, adding a new earnings threshold to the previously proposed debt-to-earnings ratios.

For-profit schools are once again on the defensive, and one of their arguments seems designed to get even nonprofit and public schools nervous. Advocates for for-profit colleges claim that gainful employment rules unfairly penalize schools that serve students of color and historically disadvantaged students, even though these students may have poorer labor market outcomes because of factors outside the control of colleges, such as disinvestment in the K-12 system and structural racism in the job market. Perhaps influenced by this worry, representatives from community colleges, minority-serving institutions (MSIs), and other colleges voted down the Biden administration’s gainful employment proposal earlier in the regulatory process.

Are for-profit schools right that regulations would cause financial ruin to colleges providing real value to students of color? To find out, we turned to a dataset the Department of Education created to estimate gainful employment outcomes. We calculated the number of passing and failing programs at each institution, weighted by the number of degrees awarded in each program. For more on the methodology, data limitations, and upper-bound estimates using an alternative approach to missing data, see the appendix at the bottom of this page.

Most programs at HBCUs easily pass gainful employment regulations.

We start by looking closer at a subset of MSIs, Historically Black Colleges and Universities (HBCUs). This small yet important sector is a good place to start, especially because the 100 HBCUs in the dataset make for intuitive statistics.

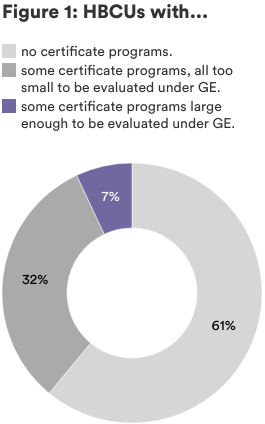

Out of the 100 HBCUs, 61 grant no awards in certificate programs, meaning none of their programs are subject to the gainful employment tests. Thirty-two HBCUs have some certificate programs that automatically pass because they are too small to be evaluated (the darker grey in Figure 1). In 20 of these 32 schools, certificate programs make up less than 3 percent of their total awards. Just seven HBCUs have certificate programs large enough to be evaluated under gainful employment metrics.

The next chart, Figure 2, shows how each HBCU would fare under the regulations, with each bar representing one school. The color of the bars shows the proportion of degrees at each school that would pass, fail, or not be subject to the regulations.

Out of the seven HBCUs with programs large enough to be evaluated, only four have any failures, represented in red in Figure 2. These programs are a small part of their respective institutions. The four HBCUs already grant more than 80 percent of their degrees in programs that pass or are not subject to gainful employment. Even at the HBCU with the most failures, only one of the school’s approximately 30 programs falls short.

In other words, of the few HBCUs impacted by the gainful employment regulations, all should be able to adapt by expanding their successful programs to accommodate the other students. And, of course, 96 percent of HBCUs have no failing programs at all (see Figure 3).

MSIs and community colleges also sail through the regulations.

Other colleges in the public and nonprofit sectors that serve many students of color fare similarly well. Among minority-serving institutions— a category that we defined to include HBCUs, tribal colleges, Hispanic-serving institutions, and other schools that meet federal designations related to the proportion of minority students —only 6 percent grant any degrees in failing programs. Similarly, only 5 percent of community colleges have any graduates in programs that would fail gainful employment.

As Figure 4 shows, only a tiny fraction of schools in any sector apart from the for-profit sector currently grant more than 10 percent of their degrees in failing programs. At this level of failure, gainful employment should be manageable for institutions since they can expand their passing programs (or improve their almost-passing programs) to provide students with higher-value options. Across all nonprofit and public schools, 97 percent have fewer than 10 percent of graduates in failing programs. This includes 99 percent of community colleges, 98 percent of minority-serving institutions, and 98 percent of HBCUs.

MSIs have better student outcomes than for-profits.

Of course, for-profits allege that other schools sail through the gainful employment regulations because most of their programs are exempt from the rules. This exemption is based on the law—the Higher Education Act clearly defines which programs are gainful employment programs. Even so, do for-profit programs only seem lower quality because all of them are evaluated under the gainful employment rules?

To find out, New America used College Scorecard data to estimate the effect of an earnings threshold on all programs. There are not enough data to calculate debt-to-earnings ratios for all schools, but the earnings threshold accounts for 80 percent of all gainful employment failures as weighted by the number of credentials. For more information, download the appendix below.

We found that HBCUs, tribal colleges, and other MSIs have an easy time passing gainful employment, not just because most of their programs are exempt but also because they provide a higher-value education to their students. The vast majority of MSIs (82 percent) grant fewer than 10 percent of degrees in programs that would fail the earnings threshold (see Figure 5). Only 3 percent of MSIs have more than half of graduates in failing programs. In other words, MSIs would fare well even if all of their programs were held to the earnings threshold, as for-profits are.

For-profits often serve students poorly.

On the other hand, half of for-profit schools would no longer be able to offer federal financial aid in at least half of their programs (as weighted by the number of degrees awarded), and 40 percent would no longer be allowed to offer aid at over 90 percent of their programs. One reason for the high concentration of failing programs is that for-profits are likely to be small schools focused on one low-paying industry. For example, about half of the for-profit schools are cosmetology schools, a sector that produces low wages even when factoring in a small amount of unreported tipped wages.

Still, the difference by sector is striking. Overall, 30 percent of degrees at for-profit schools would fail the gainful employment earnings threshold, compared to 5 percent of degrees at MSIs. The difference in failure rates holds even for certificate programs, for which we can estimate both the earnings threshold and the debt-to-earnings ratios at all schools. Among the certificate programs large enough to have data, three-quarters would pass gainful employment at public and nonprofit schools, compared to 40 percent at for-profit schools. The fact that for-profit programs perform so much worse than programs at other colleges serving a high portion of students of color suggests there is something about for-profit institutions—not their students—that lead to poor post-graduation outcomes.

Other researchers have confirmed as much. Many have pointed out that students at for-profit schools have higher default rates and lower earnings, even after statistically controlling for student characteristics like race, family income, and standardized test scores. Researchers at the Federal Reserve recently used a new method to isolate the causal effect of attending a for-profit school instead of a public school. They found that for-profit enrollment caused the default rate among four-year students to almost double. The defaults occur because for-profits saddle students with higher debt and, as confirmed in other studies, lower post-graduate earnings. Poor outcomes at for-profits are decidedly not because of student demographics.

Conclusion

Nonprofit and public colleges should not worry about the forthcoming gainful employment regulations. All these schools, including the ones with many students of color, can continue operations as usual. The vast majority of their programs easily pass the proposed regulations, not just because many are exempt, but because their programs are of high enough quality to pass the tests.

The opposite is true at for-profit schools with a concentration of failing programs, which may find much of their federal financial aid cut off. We know what to expect next, thanks to a study of the last time the government cut off federal aid to low-quality schools in the 1990s. Many for-profits did shut down, and people who would have enrolled in the for-profit schools instead attended their local community college, where they went on to have fewer defaults and higher earnings. This means that some community colleges might be able to look forward to higher enrollments thanks to the gainful employment regulations. Nonprofits and public schools have good reason to stop worrying about—and even start rooting for— strong gainful employment regulations.

This is part of a collection of New America's recent work on gainful employment. Read about: This analysis updated with new data | Our support for the proposed rule | Ways to strengthen the rule | One borrower's experience without GE protections | GE's earnings threshold compared to a minimum wage | Required GE disclosures will be even lower than expected

Enjoy what you read? Subscribe to our newsletter to receive updates on what’s new in Education Policy!