Big News for Investors: TINA is Dead

Thanks to rising bond yields, the era of `There Is No Alternative’ besides stocks for income is finally over.

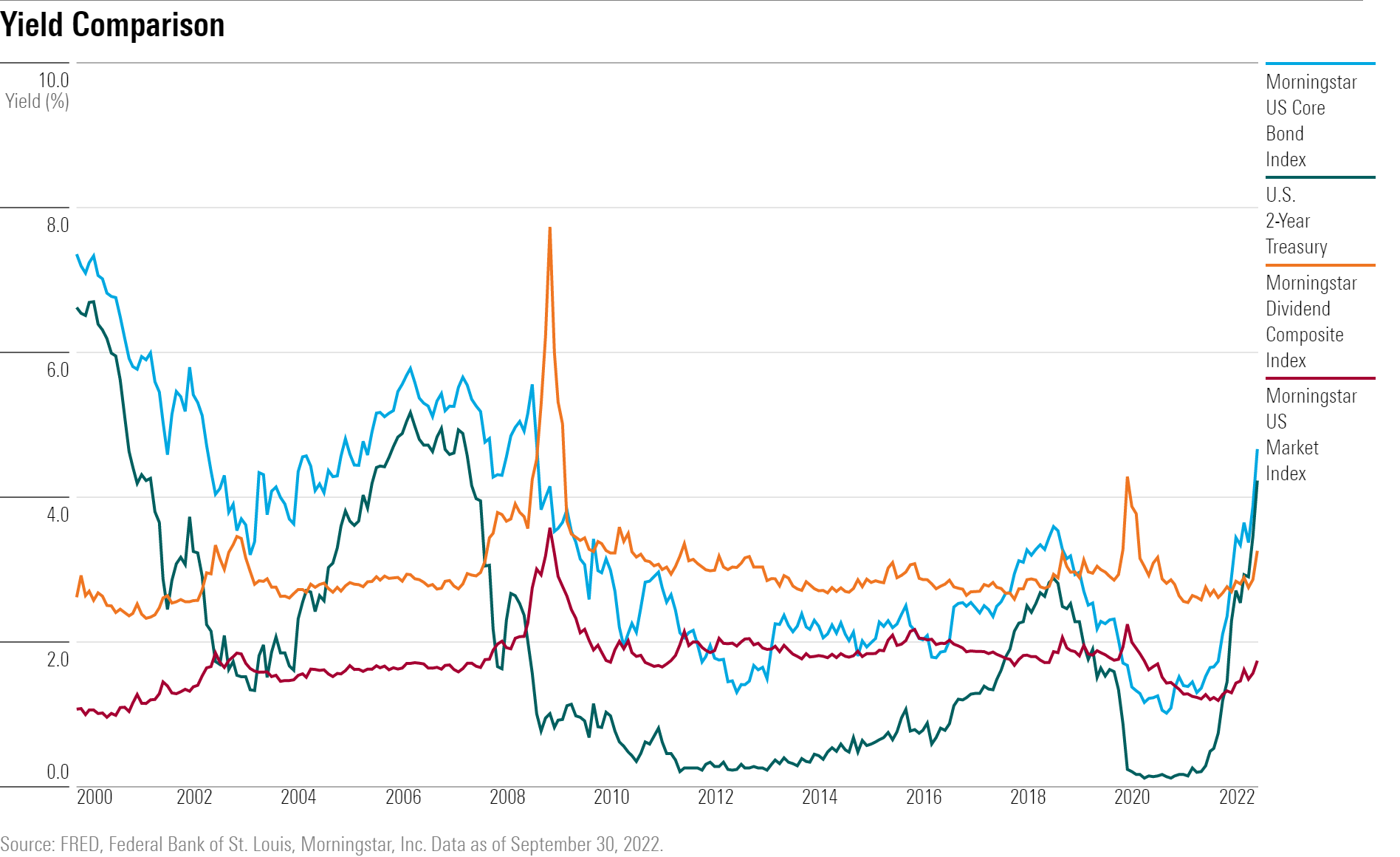

It’s been hard to find a silver lining in 2022′s markets, but here’s one: It’s finally possible to earn some income in bonds.

With that development, market observers say, we’re seeing the demise of one of the catalysts behind the big bull market in stocks over the last 14 years: TINA.

TINA stands for “There Is No Alternative.” And for years, income investors had no choice but turn to the stock market for yield thanks to many years of the Federal Reserve holding interest rates at rock-bottom levels.

But now that’s over, thanks to the Fed’s unprecedented series of interest-rate increases and the big jump in bond yields.

“TINA is dead,” says Jason Trennert, chief investment strategist at Strategas Research Partners, who helped popularize the term for the stock market back in 2013. “Investors are going to have other, very viable alternatives for their savings.”

New acronyms are now popping up. “TARA” is short for “There Are Reasonable Alternatives.” There’s “CINDY” for “Credit Is Now Delivering Yield,” and “TIAA,” which besides being the name of the giant money manager primarily serving academics, stands for “There Is An Alternative.”

While it’s difficult to quantify the impact that TINA had on the stock market by diverting money into equities that would have otherwise been invested in bonds, market observers say that without TINA, there is clearly one less source of demand supporting stock prices. “TINA was not the only reason for the equity bull market we had, but it definitely contributed,” says Hong Cheng, portfolio manager at Morningstar Investment Management.

What Is TINA?

Understanding the TINA dynamic means going back to the wake of 2008 financial crisis when the Fed, in an effort to stabilize the economy, cut the federal-funds rate to zero and flooded the financial markets with cash through the massive purchases of bonds, an effort known as Quantitative Easing, or QE for short. For years after the financial crisis, the Fed kept the funds rate at extremely low levels, which with little inflation, meant yields across the bond market were also extremely low by historical standards.

Interest rates stayed low for the better part of a decade, and were just beginning to rise when the pandemic hit, prompting another round of zero interest rates and QE.

For investors, TINA presented a dilemma. Stick with safety and earn almost nothing in yield. Hunt for yield and take on more risk in the stock market. “Income investors had a very hard time during TINA,” says Roger Aliaga-Diaz, head of portfolio construction and chief Americas economist at Vanguard Group.

Rather than bonds, investors sought yield in dividend-paying stocks such as real estate investment trusts or energy-focused master limited partnerships. And within the fixed-income market, money poured into bonds with greater volatility and higher risks of default than safe U.S. government bonds, such as emerging-markets debt or bank loans.

“They had to go somewhere, but there were consequences of stretching for yield,” says Morningstar’s Cheng.

The effect of leading investors into riskier investments was intentional, says Liz Ann Sonders, chief investment strategist at Charles Schwab. “The impetus of going to a (zero interest rate policy) and more QE was to push people out the risk spectrum in order to get the economy going again,” she says.

Another aspect of QE was that the Fed’s support of the markets made those riskier investments appear safer than historically had been the case. QE “created a unique environment in which there was a sense that the markets would be bailed out by central banks,” says Vanguard’s Aliaga-Diaz. “Stocks had implicit protection” by the Fed.

As a result, “you had dual (forces) making stocks attractive,” he says. “They were the only source of returns because bond yields were so low and you had that implicit central bank guarantee.”

The End of QE, the Start of QT

But now, times have changed.

With the surge in inflation, the Fed has raised the federal-funds rate at a record pace, taking it from zero at the start of the year, to a target of 3% to 3.25%. Investors expect the Fed to raise the funds rate again in early November, to a 3.75% to 4% target, and again in December.

At the same time, the Fed has been reversing the QE engineered to prop up the economy during the pandemic-sparked recession, a process called quantitative tightening, or QT.

“The Fed and QE created TINA and the Fed and QT killed it,” says Trennert. “TINA is over because the Fed no longer has the luxury of suppressing interest rates and no longer the luxury of quantitative easing.”

Trennert sees broad implications from the onset of QT, the end of QE, and the end of TINA. “This transition … is one of the biggest regime changes for investing in a long time,” he says.

What the Death of TINA Means for Stocks

With TINA gone, the stock market—and riskier investments in general—have lost a source of demand. “There’s no question that many investors, because they couldn’t get yield on safe investments, had to move out the risk spectrum,” says Schwab’s Sonders.

Trennert says that TINA had been a particularly powerful motivator to buy stocks among pension plans and endowments that have mandates targeting a specific rate of return.

“If your average state pension plan has an expected investment return of over 7%, and if a 10-year Treasury is yielding 1% or 2.5% or even 3%, it’s hard to get there,” he says. “But as we speak, the 2-year Treasury is yielding 4.2% (now up to 4.5%) and that’s double the dividend yield of the S&P 500. That’s below the rate of inflation, and a heck of a lot better than zero, and it’s probably going to get you a decent portion of what equity returns will be over the next several years.”

Morningstar’s Cheng says the rise in yields has created options across the bond market. She notes that a diversified core bond index, such as the Bloomberg U.S. Aggregate Bond Index, is now yielding 5%, roughly three percentage points higher than earlier this year, and high-yield bonds are now yielding nearly 10%, roughly five percentage points higher. So even in the case of bonds, which carry a level of default risk that could get hurt in a recession, “the risk/reward for bond investors has gotten much better,” she says. But in the stock market, investors, “will need to be more selective.”

Vanguard’s Aliaga-Diaz says the post-TINA investing world is a better one for investors looking for income. “It will be more natural to have income in the portfolio without overstretching into risk,” he says. “It’s good news for income investors.”

The author or authors do not own shares in any securities mentioned in this article. Find out about Morningstar’s editorial policies.

/s3.amazonaws.com/arc-authors/morningstar/ed529c14-e87a-417f-a91c-4cee045d88b4.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/F2S5UYTO5JG4FOO3S7LPAAIGO4.jpg)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/7TFN7NDQ5ZHI3PCISRCSC75K5U.png)

:quality(80)/cloudfront-us-east-1.images.arcpublishing.com/morningstar/QFQHXAHS7NCLFPIIBXZZZWXMXA.jpg)