Recommended

When the pandemic first struck, dealing with excessive debt and debt service burdens of developing countries figured prominently on the international response agenda. The G20 produced the Debt Service Suspension Initiative (DSSI)—a program to defer official debt service due by mostly low-income countries (LICs) in 2020 which was then extended through the end of 2021. Despite some bickering about full participation among the main official creditors and the de facto non-participation of private creditors, the DSSI delivered $6 billion of relief during 2020 and a further $7 billion in 2021 for the 48 countries which signed up. In parallel, the IMF added $851 million by extending its own program of debt service relief on outstanding IMF loans due from 29 of the poorest countries.

As the year progressed, the financing discussion shifted to the volume, speed, and terms of new money. The international financial institutions (IFIs) moved in varying degrees to scale up and simplify the terms of their financial support. The World Bank and other multilateral development banks (MDBs) disbursed around $100 billion in new lending in 2020 and the IMF added another $52 billion. The allocation of $650 billion in special drawing rights (SDRs), an IMF reserve asset, last August provided $173 billion of much-needed liquidity relief to emerging market and developing economies (EMDEs). And although they provided no debt service relief, private lenders did come forward with nearly $90 billion of new lending, including $14 billion to the DSSI countries. The combination of low global interest rates, new money from official and private creditors, some debt relief from official creditors, and a milder- and slower-than-expected spread of the pandemic to many developing countries meant that the widespread debt crises being predicted for 2021 have not happened—yet.

The story for developing countries in 2022 may be very different. The global economy is slowing across all country groups. For developing countries, the impact of the Omicron variant comes on top of a continuing pandemic fed by lagging vaccination rates. A faster-than-expected interest rate increase in the global financial markets, by hawkish central bankers reacting to allegations of having been behind the inflation curve, could well result in a sudden stop of capital which will impact emerging markets disproportionately. The ending of the DSSI will have an immediate cash flow impact: an $11 billion increase in debt service flows from the DSSI-eligible countries, concentrated in the countries that are most debt-distressed. Finally, the temporary liquidity boost from the SDR allocations will also be used up soon. All in all, an already fragile recovery for both emerging market and developing economies is beginning to look even more precarious.

And in the meantime, EMDE debt stock continues to increase. In the most recent report from the World Bank, 60 percent of low-income countries are now either in or at high risk of debt distress. A few middle-income countries also find themselves with worrying levels of debt and the risk of interrupted market access. And as a recent paper from the World Bank points out, “debt levels will likely continue to rise in the near future.” Given these factors it is not unreasonable to assume that during 2022 debt problems will break the surface in several EMDEs.

To address the problem of unsustainable debt levels, the G20 reached agreement in November 2020 on a Common Framework for Debt Treatments which aimed to deal with insolvency and protracted liquidity problems in the DSSI-eligible countries by providing debt relief consistent with the debtor’s capacity to pay and maintain essential spending needs. The value added by the Common Framework was to bring the newer official creditors, notably China which had become the largest official creditor for many developing countries, into a process that was akin to that used to restructure the debt owed to the—mostly OECD—members of the Paris Club. It also stipulated that private creditors would have to provide comparable relief on the debt owed to them but without clarity on how this was to be enforced.

A year later, the Common Framework is struggling to maintain its credibility. Agreement on general principles has proved much harder to translate into operational outcomes. Despite its name, the Common Framework is essentially designed to operate case-by-case. But of the three countries—Chad, Ethiopia, and Zambia—that have so far asked for their debt to be treated, none have been able to complete the process. In the interim, they have continued to service their debt to private creditors and their access to financial markets has been hampered by uncertainty regarding future debt relief. This long, drawn-out process with a vague and uncertain end and no interim relief is both challenging for participating countries and discouraging for other countries with serious debt problems.

The problem is now recognized by the IFIs that have been charged to make it work. The President of the World Bank told the G20 in October 2021 that “Progress on debt has stalled. I urge you to explicitly accelerate the implementation of the Common Framework, request transparency and reconciliation of debt, and require the participation of private creditors.” The Managing Director of the IMF noted in a blog that the Common Framework had ‘yet to deliver on its promise” and that “quick action (was) needed to build confidence in the framework.”

Between them, they have also set out a list of actions which would make the Common Framework fit for purpose. To move at a faster pace and make substantial progress, the steps and timelines in the Common Framework need to be clearer for official creditors and the incentives stronger for private creditors, including non-bank ones, to join in. Comparability of treatment and how it will be effectively enforced remains a central problem that needs to be addressed. A freeze on debt service payments while the process unfolds would provide interim cash flow relief to stressed debtors and an incentive to all to bring the process expeditiously to conclusion. And eligibility for support under the Common Framework should be extended to other heavily indebted lower-middle-income countries, beyond those currently covered.

So, now we know that the Common Framework as currently structured is not up to the task and what is needed to fix it. However, knowing what to do is not the same as getting it done and that is where the risk now lies.

The IFIs have passed the ball back to the G20. The presidency of the G20 is in transition and Indonesia, the incoming chair, will have many pressing items on the agenda—dealing the with current pandemic and strengthening preparations for future ones, enabling a sustainable energy transition, and securing common prosperity through digital transformation. Getting consensus on debt issues is always difficult, even more so when it entails getting private creditors to share the burden. And it doesn’t help that some of the major G20 creditors don’t agree on what debt should be covered by this framework or how comparability of treatment should be applied. In this context, there is a serious risk that the operationalization of the Common Framework will continue at its current pace, dealing with debt distressed countries only when they come for help, which will generally be once they have exhausted their reserves and have no options left. No matter that cleaning up the consequences will almost certainly be more expensive than acting earlier and that, in the meantime, the strains will continue to build in vulnerable countries. The poverty numbers will tick up and development outcomes will suffer as we all wait for the process to work itself out.

It doesn’t have to be like this. Even within the broad approach of the Common Framework, a combination of some key policy decisions and a more proactive approach to working with the eligible countries and their creditors could significantly speed up the process and bring relief earlier for hundreds of millions. The necessary policy decisions have already been set out by the IFI heads. I would add two points.

First, the IMF and World Bank should be asked to complete preliminary assessments of the debt relief needed by each country eligible for treatment and present the results at the Spring Meetings of the two institutions in April 2022. It is essential that the underlying debt sustainability analysis is realistic on growth and fiscal projections and clear on the implications for haircuts where needed. And it needs to be based on ‘accurate’ and comprehensive debt data for which debt transparency is essential by both debtors and creditors. This analysis would provide some overall estimates of the nature and magnitude of debt relief that will be needed to restore sustainability for these countries, fully recognizing that the pace at which the process would unfold for each country would depend on agreements on the accompanying policy framework and that the preliminary estimates would need to be revised at the time of final agreement. This type of aggregate assessment was very useful in sustaining momentum for progress under the previous Highly Indebted Poor Countries (HIPC) initiative and it should have the same impact for the Common Framework.

Second, implicit in the design of the Common Framework is the use of an IMF financing program to obtain the necessary assurances of debt relief from both official and private creditors. Where private creditors fail to engage constructively in the process, the IMF can ‘lend into arrears’—essentially provide funding while the country runs up arrears to these creditors. That policy has recently been updated to include not just uncooperative private creditors but also official ones. The ability for the IMF to lend into arrears is potentially a very powerful tool for getting recalcitrant creditors to the table, but the IMF can only use this tool if it has the full support and political cover of its major shareholders. The G20 need to signal very clearly that the IMF will insist on debt service standstills in cases of insolvency where debt restructuring needs to happen and condition its finance on such standstills so that it is not enabling unsustainable payments to select creditors (and therefore noncomparable treatment).

To make any of the above improvements, the debt issue needs to move higher up on the political agenda. How can that be done? For a start, the potential beneficiary countries need to make this a central issue in their dialog with their G20 partners and with the IFIs. For example, when African leaders united around an ask of China on SDRs, China stepped up and recycled 25 percent of its share—proportionally more than the G7 have so far offered. This is encouraging. One moment for coordination of African indebted nations can come via the United Nations Economic Commission for Africa (UNECA) council of finance ministers meeting scheduled in March.

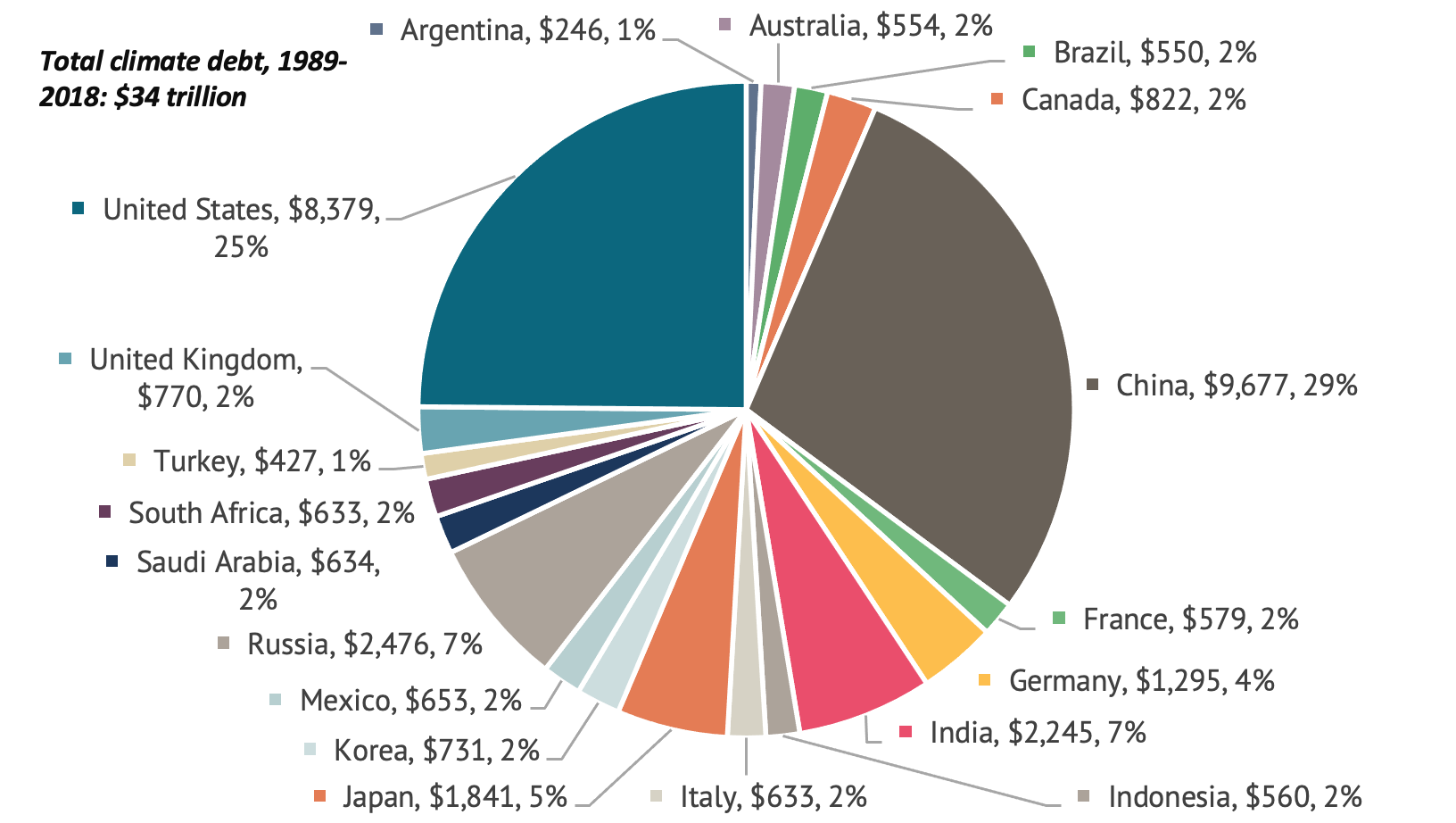

China’s role as the dominant bilateral creditor for the countries covered by the Common Framework also needs to be more explicitly recognized in the institutional arrangements for the implementation of the framework. The chair of the Paris Club said recently that China’s increasingly dominant role as a lender to poor countries has deterred many of them from seeking debt relief for fear of losing access to future Chinese funds, and nations “didn’t want to create difficulties with China.” That dynamic will only change when China takes on a more active co-owner role for the Common Framework. This implies a more forward leaning position by China to take on this responsibility, but it also requires the traditional creditor countries of the G7 to fully accept and support this new reality.

Beyond the G20, the upcoming German presidency of the G7 and the French Presidency of the European Union offer further opportunities to make progress. It was under the last Germany Chancellor of the SPD party, Schroder, that the G7 advanced the debt issue considerably; the SPD now holds the chancellorship again. A strong and coordinated push by the leadership of the World Bank and the IMF can also focus the attention of global financial leaders and of private creditors. Finally, civil society and influential global philanthropic entities can make this a prominent plank of their work and advocacy for the year to come.

Political will and international leadership have not been the hallmarks of the international response to the COVID pandemic and its associated development impact. So far, a patchwork of short-term debt service relief and new lending has kept the EMDE debt problem from spilling over. But both historical experience and the economic headwinds ahead ensure that these measures will prove insufficient. The question is whether global finance chiefs and the IFIs can forge a more comprehensive and ambitious approach before the world stumbles into the next round of country debt crises.

We are grateful to Mark Plant, Nancy Lee, Jamie Drummond, Fiona Robertson, and Aldo Caliari for valuable comments and suggestions.

Disclaimer

CGD blog posts reflect the views of the authors, drawing on prior research and experience in their areas of expertise. CGD is a nonpartisan, independent organization and does not take institutional positions.