Casey secured tax credits in Inflation Reduction Act for investments made in in “energy communities”

Tax credits incentivize building clean energy in communities with economies dependent on coal, oil, or natural gas

In May, Casey invited a Pittsburgh witness to testify at Senate Finance Committee hearing on importance of tax credits for energy communities, like Southwestern PA

Companies that invest in energy communities get a 33% boost in tax credits

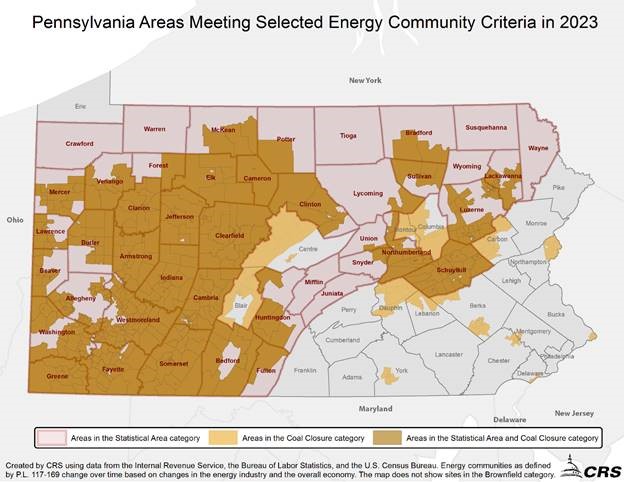

Washington, D.C. – U.S. Senator Bob Casey (D-PA) released a new map detailing the Pennsylvania communities that qualify as “energy communities” under his provision in the Inflation Reduction Act. Senator Casey’s tax credits are incentivizing companies to build and manufacture new energy projects in the communities that have powered our Nation for generations, creating well-paying jobs, and attracting new investment.

“Our coal communities have a storied tradition of powering our Nation since the Industrial Revolution and that’s what makes them uniquely qualified for new energy jobs,” Senator Casey said. “With the new tax credits I fought for in the Inflation Reduction Act, more clean energy projects will be built in our communities and Pennsylvania workers will continue to light the way into the future.”

As the Biden Administration worked to implement Senator Casey’s tax credits, the Senate Finance Committee held a hearing on the energy community tax credits in May 2023. As a member of the Committee, Senator Casey invited Patty Horvatich, Senior Vice President, Business Investment at the Pittsburgh Regional Alliance, an affiliate of the Allegheny Conference on Community Development, to testify on how Southwestern Pennsylvania is well-equipped to compete for new energy and manufacturing investments and to explain the impacts they will have on the region. She testified that the new incentives were already driving new business interest in investing in the region.

The Inflation Reduction Act provides a bonus tax credit worth 10 percent of the cost of any clean energy project placed in an energy community, defined as a brownfield site, an area with significant fossil fuel employment, or a census tract or any immediately adjacent census tract with a recent coal mine or coal plant retirement. The tax credits are administered by the Treasury Department and the Internal Revenue Service, in close collaboration with the Department of Energy. The Treasury Department’s announcement and information on qualifying for the bonus credit can be found here.

See below the map of areas in Pennsylvania that may be eligible for the Energy Communities Bonus Credit: