Pleasures are to be avoided if they result in greater pain, and pain is to be welcomed if it results in greater pleasure. – Epicurus

Pleasurable investing is an oxymoron. Good luck adopting buying high and selling low into your investment policy.

The human body’s reactions to pain provide sound investing advice.

Our default state is Homeostasis. Balancing pleasure and pain is never-ending. After a Dopamine overdose, the body brings order to the crime scene. Examples include crashing after a sugar high and head-splitting hangovers after alcohol overindulgence.

We’re a Dopamine Nation.

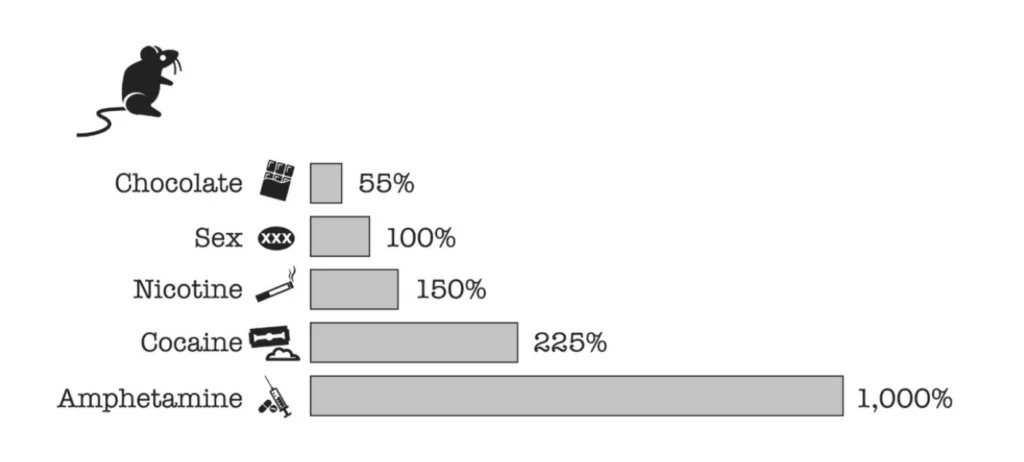

This chart measures the percentage dopamine increase of a rat trapped in a box when exposed to various substances.

Anna Lembke drops knowledge in her ground-breaking book, Dopamine Nation. She compares food, sex, drug, and technology addiction to a pendulum. When the pendulum is overweight pleasure, pain gremlins jump onto the other side, throwing things back into balance. Pain overcompensates, leading to the need for more Dopamine to maintain Homeostasis. Addiction creates massive pain.

What happens if we reverse engineer pain and pleasure?

Dr. Lembke states: Pressing on the pain side of the balance can lead to its opposite – pleasure. Unlike pressing on the pleasure side, the Dopamine that comes from pain is indirect and potentially more enduring.

Pleasure gremlins jump on after the initial pain creating longer-lasting pleasure; intermittent exposure to pain makes us less vulnerable.

Cold showers and baths are initially painful. Our bodies eventually numb themselves to the exposure.

According to Dr. Lembke: Dopamine rose gradually and steadily throughout the cold bath and remained elevated for an hour afterward.

Exercise is the ultimate example.

Exercise is immediately toxic to cells, leading to increased temperature, noxious oxidants, and oxygen and glucose deprivation.

Then this happens.

Exercise increases many of the neurotransmitters involved in positive mood regulation: Dopamine, serotonin,…..Exercise contributes to the birth of new neurons and even reduces the likelihood of using and getting addicted to drugs.

Acupuncture falls under this category. Minor pain prevents larger doses from asserting their will.

What does this have to do with investing?

It scientifically backs the old saying regarding the markets; If it feels good, you’re probably doing something wrong.

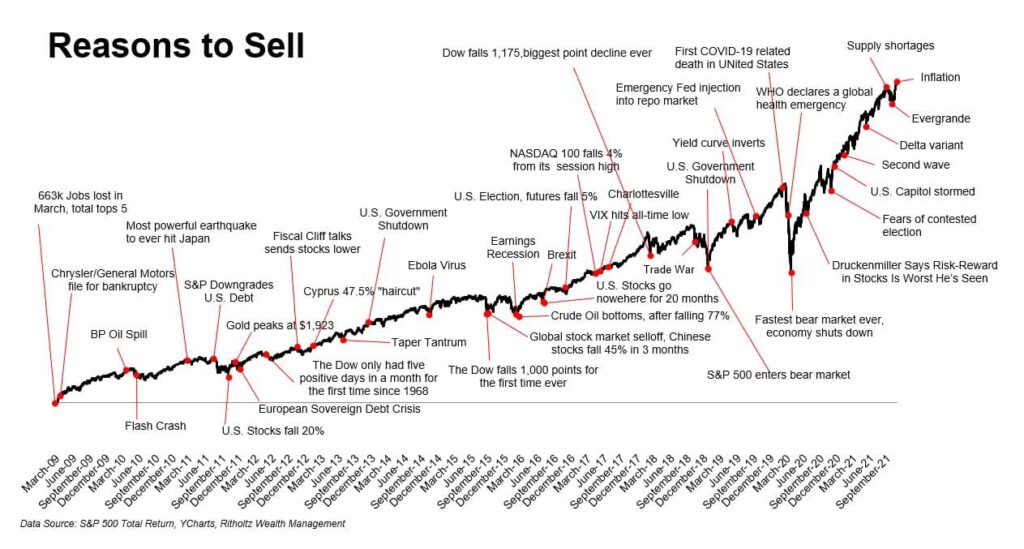

Selling your stocks in a crisis creates a momentary dopamine rush. While temporarily pleasing, the long-term market gremlins hop onto the pain side of the pendulum. Your portfolio and wealth may never recover from the extended period of suffering they unleash on your wealth and psyche.

Balancing the agony and ecstasy of the markets isn’t easy.

Investors must embrace the pain when markets fall precipitously. Short-term torture eventually morphs into self-correcting market homeostasis producing sustainable pleasure.

Credit cards offer a dopamine rush. The temporary pleasure of purchasing disposable goods doesn’t compensate for the long-term destructive effects of minimum payments attached to a 20% interest rate. The momentary disappointment of walking out of the store empty-handed is justified if you don’t have the funds to pay in full.

Phil Pearlman more than gets it.

And we live in a world where comfort is so accessible that seduction is almost unfair.

We have air conditioning in the summer, heat in the winter, a fridge stocked with food and drink, and if we don’t, we can order anything from our couch and have it sent to us in minutes or overnight in dry ice via Federal Express.

I thought about this just this morning as I adjusted the heat function on my car seat.

All of this comfort is not good.

Regarding investing and life, PAIN isn’t a four-letter word.

Source: Dopamine Nation by Anna Lembke M.D.