Some stocks hold up well during corrections, but bear markets eventually take down everything. And that’s about where we are today. As of this morning, only nine stocks* representing $1 trillion of market cap are within 5% of their 52-week high. 145 stocks representing $9 trillion in market cap are within 5% of their 52-week low.

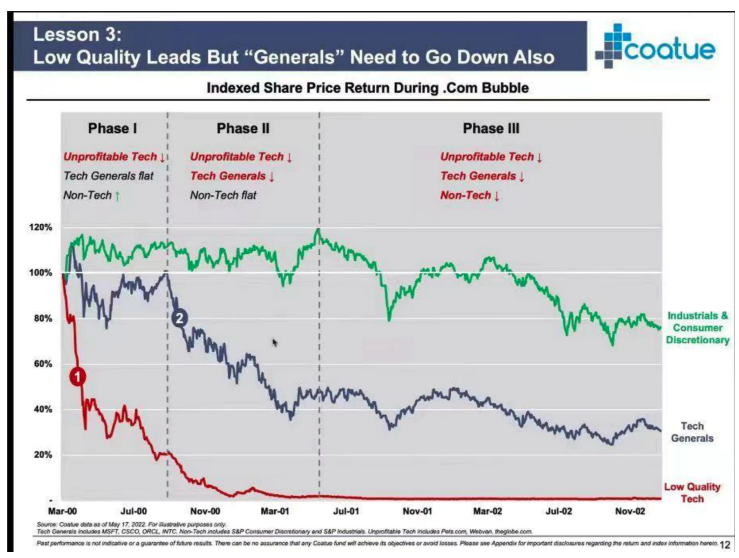

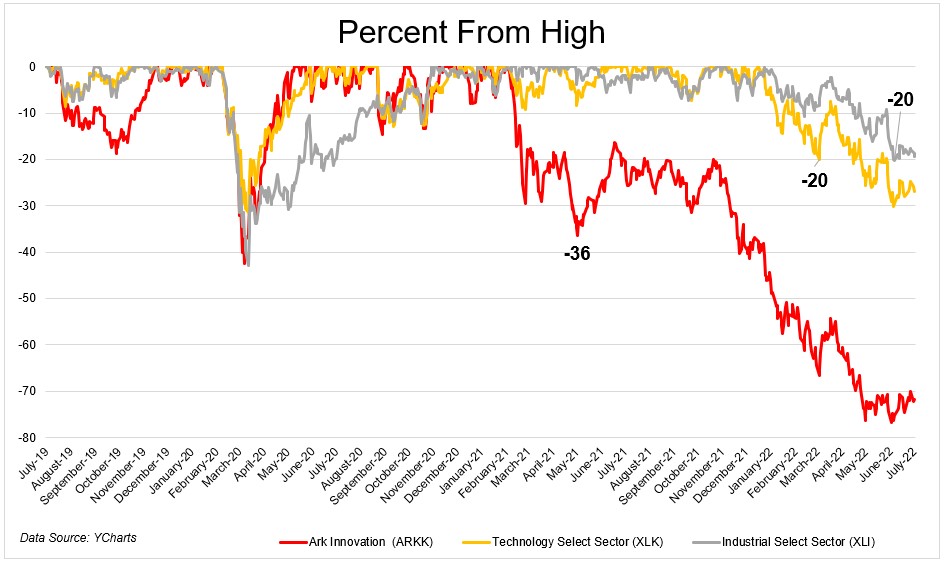

Bear markets experience indiscriminate selling, but there’s an order to it. The most speculative names get hit first, then it’s the leaders, and then it’s everything else. This chart from Coatue via Eric Newcomer shows how this dynamic plays out, using the bursting of the dotcom bubble as the playbook.

Phase I began in mid-2021. While the S&P 500 was hitting new all-time highs, unprofitable tech was getting pummeled. We entered Phase II earlier this year as the tech generals fell one by one. Microsoft hasn’t been this far below its 200-day moving average since 2012. The uptrend that it’s enjoyed over the last decade is decidedly over.

And now we’re entering phase III. As I mentioned, nine stocks in the S&P 500 are within 5% of their 52-week high. Three of them are healthcare, and six of them are consumer defensive. Extremely consumer defensive. Kellog, General Mills, and Molson Coors, to name a few People are eating cereal and drinking beer come hell or high water. But if this continues, they’ll eventually get to these too.

The list of stocks near 52-week lows is a who’s who of American business

- Berkshire Hathaway, BlackRock, Invesco, T.Rowe Price, Bank of New York Mellon, State Street, JP Morgan, Goldman Sachs, Morgan Stanley, Charles Schwab, Wells Fargo, Bank of America, CitiGroup, KeyCorp, Fith Third Bancorp, U.S. Bancorp, PNC, Citizens Financial, Prudential, Lincoln National, American Express, PayPal

- Facebook, Microsoft, Ebay, Salesforce, Service Now, Cisco, Intel, Hewlett Packard, Akamai, F5

- Dow Chemicals, DuPont, Altria, Caterpillar, Deere, General Motors

- Nike, Hilton, Hasbro, Chipotle, Darden

- Disney, Paramount, News Corp, Fox Corp

- Norfolk Southern, CSX Corporation

- Boston Properties, Simon Property Group, Digital Realty, Vornado

- 3M, Honeywell, Ingersoll Rand, Illinois Tool Works, Dover Corporation

- Expedia, Booking, Royal Caribbean, Delta Airlines

There are no winners in a bear market. Survival is the name of the game. A new bull market will begin eventually, but right now, we’re in the “everything must fall” phase.

*I used the S&P 500