Secondary Market Corporate Credit Facility Supports Main Street

Recent concerns about the spread of the COVID-19 virus and its effect on economic activity led to one of the worst months of equity returns in history from mid-February to mid-March.1 For the first two weeks or so of this wild ride in the stock market, corporate bond markets were quiescent, showing only very modest changes in yields from February 18 to March 4. In early March, however, perceptions of strongly rising risk led investors to begin moving to particularly safe assets such as U.S. Treasuries and AAA-rated corporate bonds.2 This post examines the secondary market for corporate bonds, which is a large, interdealer market with average daily volumes reaching $40 billion. We also discuss related events in the Treasury market.

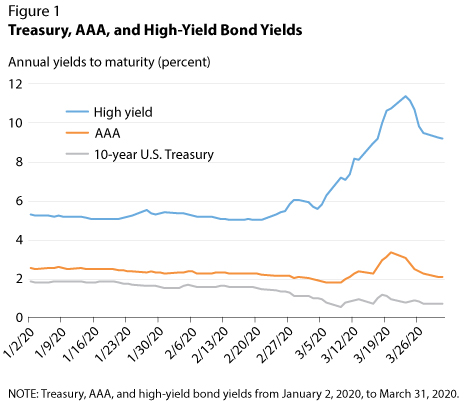

Figure 1 shows the "flight to quality" in bonds: 10-year Treasury yields have fallen from 1.88 percent at the beginning of the year down to a historic low of 0.54 percent on March 9, and they remain near that level. In contrast, as investors sold off their below-investment-grade debt, yields on such securities soared to over 11 percent on March 23 and 24. In comparison, high-yield debt had paid only 5.28 percent at the beginning of the year. Somewhat puzzlingly, AAA yields initially declined with Treasury yields through March 9 but then began to rise, temporarily exceeding 3 percent in late March. Although both AAA and high-yield bond yields declined in the last two weeks of March, the risk-spread between Treasuries and AAA bonds is much larger than it was two months ago.

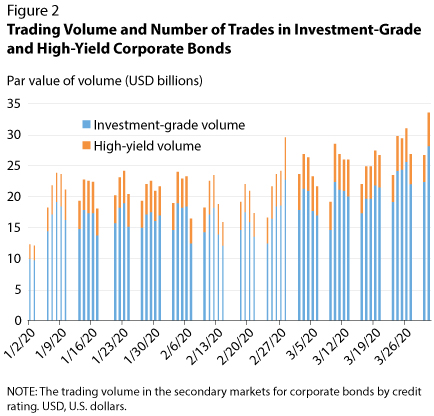

During the period of these gyrations in bond markets, trading remained strong for both investment-grade and high-yield bonds in March. The table shows that the average daily volume for investment-grade bonds rose by almost 30 percent in March over January and February, while the same figure was up 12 percent for high-yield bonds. The panels of Figure 2 confirm this visually by illustrating the trading volume in secondary markets for corporate bonds across both ratings categories.

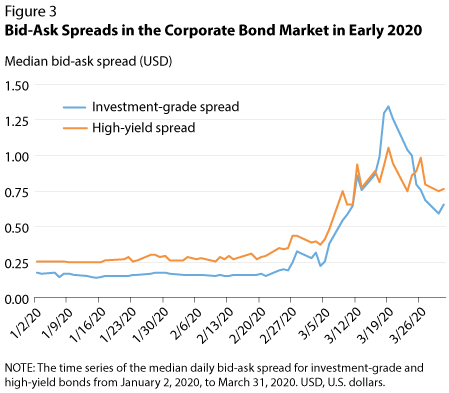

The uncertainty associated with the strong movements in yields and higher trading volume also came with sharply higher bid-ask spreads as market participants quoted higher spreads to avoid losing money in a fast-moving market. Figure 3 shows that investment-grade bid-ask spreads almost quintupled, rising from a median of less than $0.16 for investment-grade bonds in February to nearly $1.35 in March. High-yield bid-ask spreads rose nearly as strongly, from $0.26 in February to a high exceeding $1.00 in March. These bid-ask spreads are beyond those observed during the 2007-09 Financial Crisis (Mizrach, 2015). Unusually, from March 17 to March 24, investment-grade bid-ask spreads were higher than high-yield spreads. The last time investment-grade bid-ask spreads were above high-yield spreads for a sustained period was in 2010 (Liebschutz and Smith, 2016).

Corporate bond volatility and uncertainty (depicted in the tables and figures) is of concern to the Federal Reserve and other central banks and regulators. The recent trend toward greater investment by exchange traded funds (ETFs) in corporate bonds is also of concern.

The Bank of England wrote about the issue in its July 2019 Financial Stability Report (p. 35): "[L]arge‑scale redemptions from funds could result in sales of illiquid assets that may exceed the ability of dealers and other investors to absorb them, amplifying price moves, transmitting stress to other parts of the financial system, and disrupting the availability of finance to the real economy."

Consistent with the Bank of England's concern, there have been indications of real stress in the 419 fixed-income ETFs managing $847 billion in assets.3 Of these, LQD (the iShares iBoxx Investment-Grade Bond ETF) is the third largest, with nearly $40 billion invested in investment-grade corporate bonds. Figure 4 shows that the share price of LQD had declined by over 20 percent from March 6 to March 19 as high-yield bond prices fell. The Fed's decision to establish the Secondary Market Corporate Credit Facility (SMCCF) on Monday March 23, 2020, however, seems to have assisted the rally of the LQD share price.4 The share price started to rally on Friday March 20 and rose 13 percent over the next three days following the Fed's announcement that it would establish a facility to support corporate credit markets:

The Federal Reserve established the Secondary Market Corporate Credit Facility (SMCCF) on March 23, 2020 to support credit to employers by providing liquidity to the market for outstanding corporate bonds. The SMCCF will purchase in the secondary market corporate bonds issued by investment grade U.S. companies and U.S.-listed exchange-traded funds whose investment objective is to provide broad exposure to the market for U.S. investment grade corporate bonds. Treasury, using the ESF [Exchange Stabilization Fund), will make an equity investment in the SPV [special purpose vehicle] established by the Federal Reserve for this facility.5

Thus, the establishment of the SMCCF appears to have visibly assisted the corporate credit market during a period of unusually high risk and fire-sale prices.6 Although the SMCCF clearly benefits corporations that issue bonds and the investors/savers who hold those bonds, the broader economy was the much more important beneficiary. Main Street won't prosper if corporations can't borrow for investment and people see their retirement savings disappear in a financial panic.

Notes

1 See Mizrach and Neely (2020).

2 AAA is the highest corporate bond rating; such bonds are considered very safe assets, at very low risk of default. AAA bonds are not considered quite as safe as U.S. Treasuries. Standard and Poor's and Fitch Ratings use the AAA rating terminology, while Moody's describes its safest category of bonds as Aaa. Investment-grade bonds are those rated at least BBB- (Baa3 by Moody's), while "high yield" bonds are those with lower ratings.

3 ETR.com. "Fixed Income EFT Overview"; https://www.etf.com/channels/fixed-income-etfs, accessed April 10, 2020.

4 By definition, bond prices and yields move inversely.

5 Board of Governors of the Federal Reserve System. "Policy Tools: Secondary Market Corporate Credit Facility; https://www.federalreserve.gov/monetarypolicy/smccf.htm, accessed April 10, 2020.

6 On April 9, the Federal Reserve expanded the scope of its corporate bond support program. It raised the total volume of bonds to be purchased to $850 billion and opened the program to bonds that had been downgraded below investment grade after March 22. This announcement boosted the value of credit of ETFs holding high-yield securities and specific bonds such as those of Ford Motor Company that had been recently downgraded. Details on the Fed program can be found at https://www.federalreserve.gov/newsevents/pressreleases/files/monetary20200409a2.pdf.

References

Mizrach, Bruce. "Analysis of Corporate Bond Liquidity." Research Note, FINRA Office of the Chief Economist, 2015;

Mizrach, Bruce and Neely, Christopher J. "The Stock Market's Wild Ride." Federal Reserve Bank of St. Louis Economic Synopses, 2020, No. 15; https://research.stlouisfed.or....

Liebschutz, Jake and Smith, Brian. "Examining Corporate Bond Liquidity and Market Structure." Treasury Notes, July 7, 2016; https://www.treasury.gov/connect/blog/Pages/Examining-Corporate-Bond-Liquidity-and-Market-Structure.aspx.

© 2020, Federal Reserve Bank of St. Louis. The views expressed are those of the author(s) and do not necessarily reflect official positions of the Federal Reserve Bank of St. Louis or the Federal Reserve System.

follow @stlouisfed

follow @stlouisfed