The traditional wisdom is that geopolitical chaos is good for shipping demand. It disrupts trade patterns. Fleets are less efficient. Cargo must travel longer distances. Rates rise.

But Niels Rasmussen, chief analyst at shipping association BIMCO, believes Russia’s invasion of Ukraine will be bad for shipping demand.

The war “will hurt growth in all shipping segments,” he maintained in a report published Monday. Citing estimates that the conflict could shave 1% off global GDP growth, he said: “No matter the specific Russia and Ukraine export developments, this will hurt growth projections for all shipping sectors.”

Container shipping

Russia-bound container cargoes require increased inspections, slowing operations at European ports. Almost all shipping lines have now suspended service to Russia, dropping off Russia-bound boxes at other terminals en route. The result is increased congestion at European container ports. And congestion drives up freight rates.

That’s the immediate effect in one region. Looking further down the road, from a global perspective, the war could reduce port congestion, according to Rasmussen.

“The impact of the war on the global economy and consumer confidence may weaken growth prospects,” he wrote. The war’s effect on oil, wheat and corn prices could “lead to the destruction of demand as consumers and businesses prioritize spending.”

Historically high prices for ship fuel “will only add to the inflationary pressure.”

Stifel analyst Ben Nolan made the same point in a new client note. He cautioned that energy inflation could hit consumer spending. “The container industry … could be negatively impacted.”

Rasmussen said that demand destruction “could lead to an earlier ‘return to normal’ from the current elevated demand. ” That, in turn, could ease congestion in ports.”

When the traffic jam of ships off U.S. ports does finally clear, stranded shipping capacity will be injected back into the marketplace. That would create more downward pressure on freight rates.

S&P Global Platts pointed to another potential negative for container rates in the trans-Atlantic. “As major shipping lines refuse to carry cargoes to Russian ports in the Baltic Sea, more space could become available for headhaul cargoes from North Europe to the East Coast of North America,” it said. This may bring rates lower, or alternatively, compel carriers to cancel trans-Atlantic sailings to support rates.

Dry bulk shipping

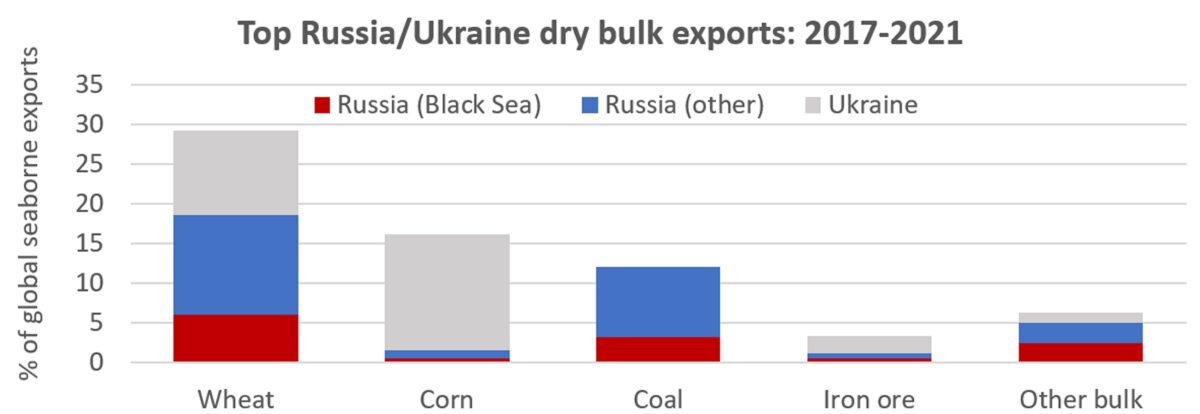

Ukraine and Russia accounted for 29.2% of global seaborne exports of wheat in 2017-21, according to data from Tradeviews.net cited by BIMCO. The two countries accounted for 16.2% of seaborne corn volumes, while Russia accounted for 12% of coal volumes.

The positive view on freight rates is that dry bulk that can’t be exported from Ukraine or Russia will be replaced by alternate sources. Those alternate sources will need to travel farther, increasing shipping demand measured in ton-miles (volume multiplied by distance). Nolan cited coal shipping as “a clear winner.”

The negative view is that not enough of the lost exports will be replaced. That would lower the “ton” multiplier in the ton-mile equation.

According to Rasmussen: “Of particular concern to global supply is the export of wheat and maize, which is mainly loaded in the Black Sea. It is difficult to imagine that what is left of Ukraine’s 2021 harvest will be shipped any time soon. Depending on developments, the 2022 harvest may also be hit.

“All in all, we believe that despite possibilities of increasing ton-mile demand for certain commodities, the war in Ukraine is a net negative for the bulk market, driven by the lack of [replacement] commodity supply and reduced demand due to price increases.”

Tanker shipping

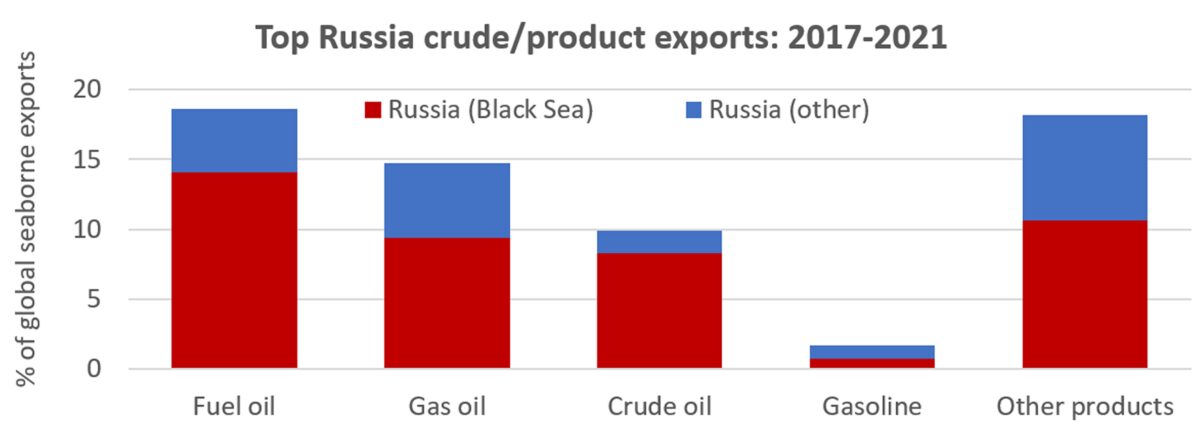

Tanker stocks have risen more than other shipping equities since the war began. The positive rate thesis for tankers is that Russian exports will have to switch destinations, increasing ton-miles for both Russian exports and EU imports.

BIMCO cited data showing that Russia was the source of 18.6% of seaborn fuel oil volumes in 2017-21, as well as 14.7% of gas oil export volumes and 9.9% of global crude oil volumes.

Russian tanker cargoes have yet to be targeted by sanctions directly. But even so, they are not being loaded because of legal and reputational concerns among buyers, tanker owners and other parties. Amid talk of potential direct sanctions on Russian energy exports, Brent crude briefly hit $139 per barrel on Monday, its highest point since 2008.

Nolan believes more Russian crude and products will head to China as opposed to Europe, a positive for ton-miles. However, he acknowledged downside risks from price-induced demand destruction as well as “too much Russian product [being] rejected by the market,” if that leads to a fall in absolute volumes.

BIMCO’s tanker outlook is negative. The combination of buyers shying away from Russian cargoes and OPEC’s decision to stick to its production schedule will keep prices high. That will destroy demand and limit the number of available tanker cargoes.

If the EU buys more oil from the Middle East instead of Russia, and Russia sells more to China instead of the EU, “this could lead to increased ton-mile demand, but if the high prices are sustained, overall demand would still suffer,” affirmed Rasmussen.

“We therefore believe that the much awaited rebound in the tanker markets will be further delayed and be more muted than otherwise expected.”

Click for more articles by Greg Miller

Related articles:

- Russian invasion propels price of ship fuel to historic high

- Shipping isn’t waiting for sanctions. It’s refusing to move Russian cargo

- Tanker shares jump as war rages; other shipping shares mixed

- Shipping braces for impact as Russia-Ukraine crisis intensifies

- Price of ship fuel surging, poised to eclipse all-time high

- Supply chain whack-a-mole: West Coast eases, East Coast worsens