The price of ship fuel was flirting with a new record even before Russia invaded Ukraine. Then war broke out, and the highs of the past were left far behind. Ship fuel costs have “gone parabolic,” said Braemar ACM Shipbroking.

To the extent the fuel cost increase is passed along to the shippers of containerized goods and bulk commodities such as oil and grain, it will add to inflation. To the extent it’s not passed on, it will lower shipping’s bottom line.

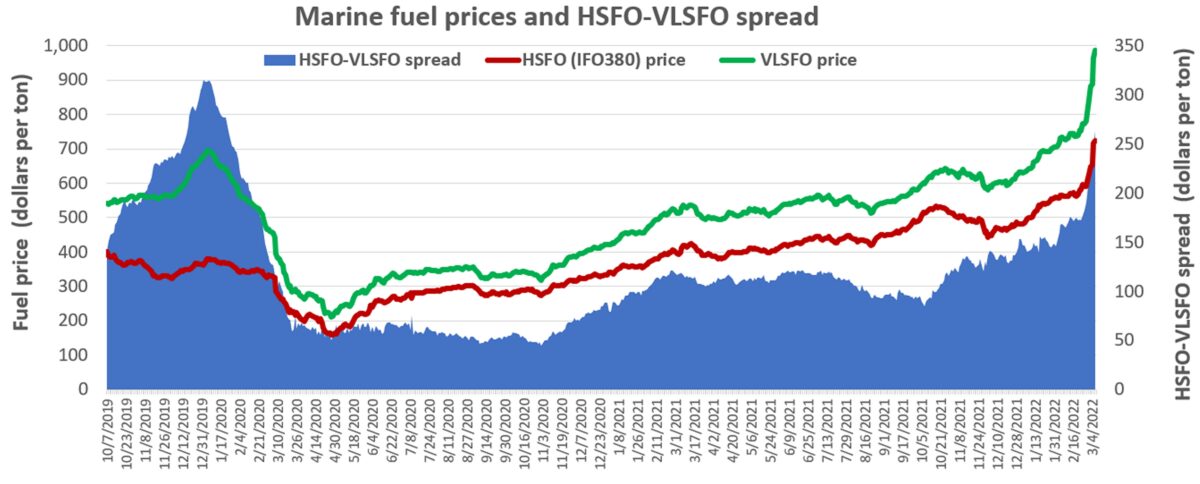

Ships consumed high sulfur fuel oil (HSFO) until the IMO 2020 environmental regulations went into force two years ago. Since Jan. 1, 2020, ships have been required to burn more expensive fuel with 0.5% sulfur content known as very low sulfur fuel oil (VLSFO). Ships equipped with exhaust-gas scrubbers can continue to burn HSFO, which has a sulfur content of 3.5%.

According to Ship & Bunker, the average price of VLSFO at the world’s top 20 bunker (marine fuel) ports reached $987 per ton on Tuesday, up 84% year on year. In two of the top four ports — Singapore and Fujairah, United Arab Emirates — the price of VLSFO reached $1,001 and $1,024 per ton, respectively. These price levels are unprecedented.

The previous average daily high for VLSFO at the top 20 ports — $693.50 per ton — was recorded by Ship & Bunker on Jan. 8, 2020, at the height of the IMO 2020 transition. Before that regulation came into effect, HSFO reached highs of $746 per ton in March 2012 and around $750 per ton in July 2008.

More price pain for container shippers

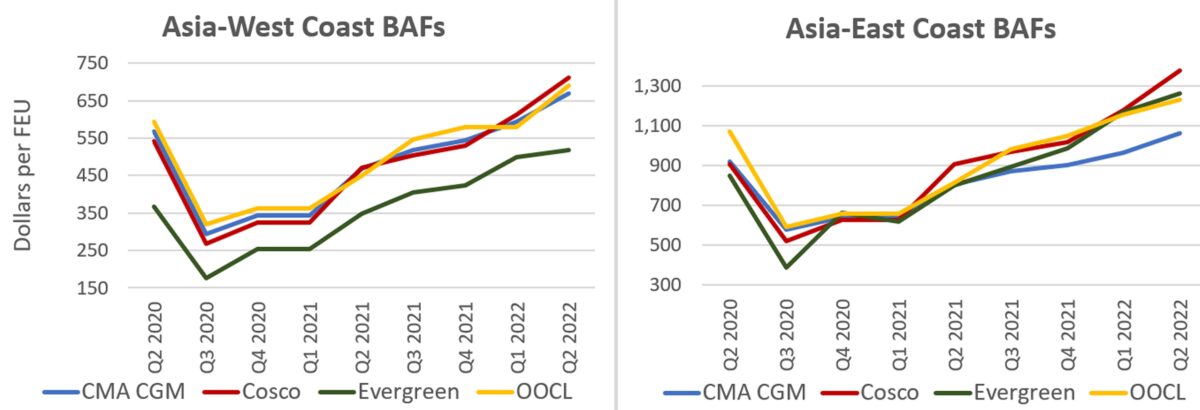

Container shipping lines pass along higher fuel costs to cargo shippers via quarterly bunker adjustment factors (BAFs) and emergency bunker surcharges. “Substantial BAF increases are coming,” warned Lars Jensen, CEO of Vespucci Maritime, in an online post.

The Q2 2022 BAFs already announced by carriers show continued increases, and these hikes may be supplemented by emergency surcharges.

The Q2 2022 Asia-West Coast BAFs of CMA CGM, Cosco, Evergreen and OOCL average $648 per forty-foot equivalent unit, up almost $80 per FEU from the current quarter and up 49% year on year. These four carriers’ Q2 2022 Asia-East Coast BAFs average $1,236 per FEU, up $115 from this quarter and up 48% year on year.

The only solace for cargo shippers is that the incremental fuel cost pales in comparison to the increase in base freight rates. Asia-West Coast rates have risen by $6,728 per FEU year on year, according to Drewry. That’s over 25 times as much as BAFs have risen in the same period.

More savings for scrubber-equipped ships

It’s not just the price of marine bunkers that’s rising: The spread between VLSFO and HSFO is also increasing, a particularly important development for tanker and dry bulk trades. On spot voyage deals, owners pay for fuel. Some ships have scrubbers and burn cheaper HSFO; the majority don’t and must use VLSFO.

As of Tuesday, Ship & Bunker put the average price of VLSFO at the top 20 ports at a $263-per-ton premium to HSFO. The last time the gap was that wide was in January 2020, during the IMO 2020 fuel transition.

The wider the spread, the greater the benefit to owners of ships with scrubbers.

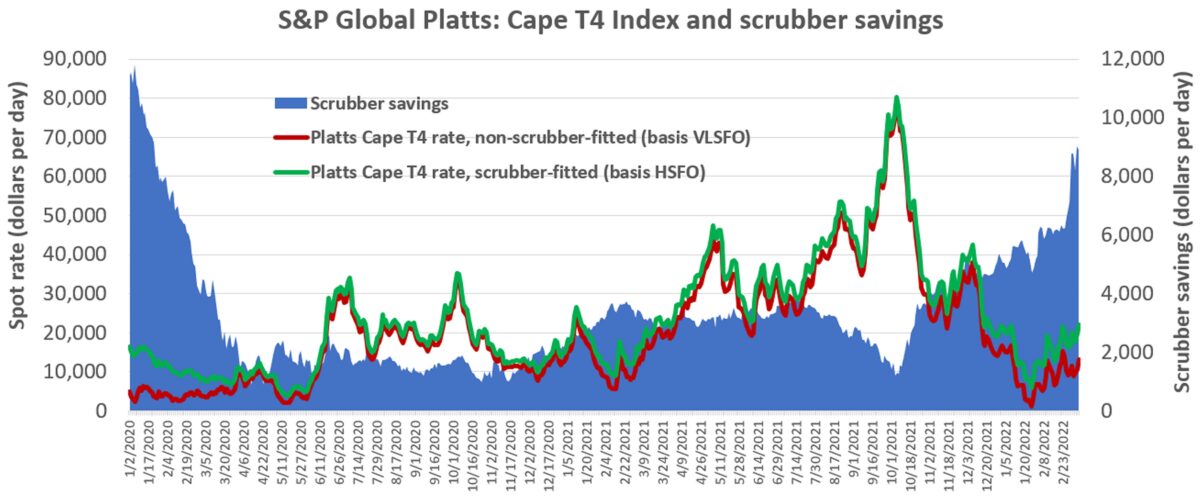

S&P Global Platts’ indexes have tracked the benefits of scrubbers over time. Its Cape T4 indexes assess rates for Capesize dry cargo carriers (bulkers with capacity of about 180,000 deadweight tons or DWT) with scrubbers and without them.

As of Monday, Platts put the rate for non-scrubber Capes at $10,592 per day, while Capes with scrubbers saved $9,037 per day in fuel, bringing earnings to $19,629 per day, almost twice as much as non-scrubber Capes. Clarksons Platou Securities puts the all-in cash break-even rate for 5-year-old Capes at $16,000 per day, implying that scrubber-equipped Capes are in the black, non-scrubber Capes in the red. The last time the Cape T4 index showed this high a spread was in January 2020.

Advantages for some public companies

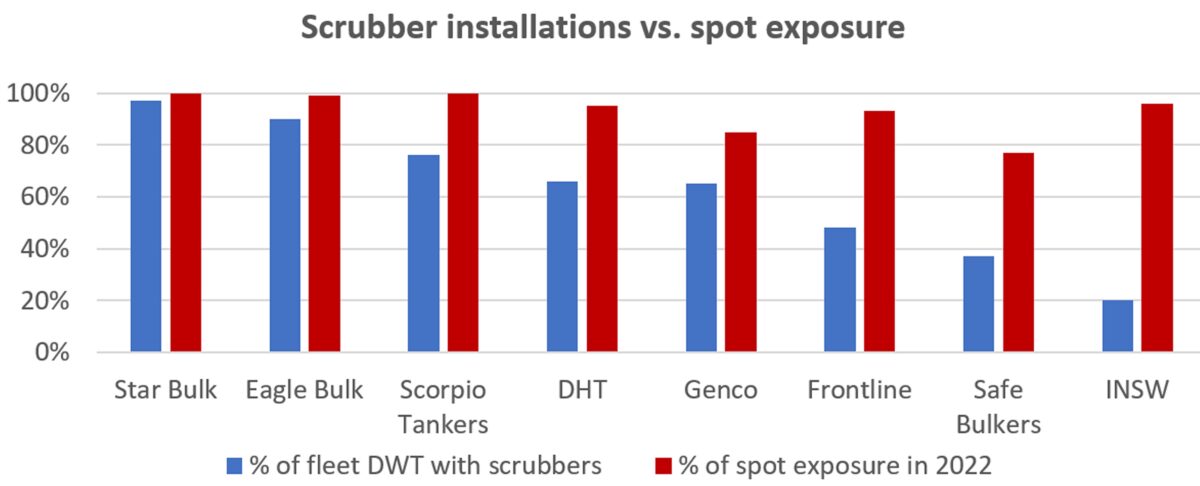

Jefferies analyst Randy Giveans highlighted what the spread means to shipping stocks in a new client note.

“In terms of who will benefit versus who will be harmed in a rising bunker fuel cost environment, we believe owners with scrubber-equipped vessels in sectors with rising rates will benefit the most. Rising spot rates will help offset the rising cost of bunker fuel, while the widening fuel spread will benefit owners with scrubber-equipped vessels via substantial fuel-cost savings.”

Jefferies assessed seven U.S.-listed shipping companies in terms of two factors: their estimated 2022 spot exposure and the share of their capacity that’s scrubber equipped. On one end of the spectrum are Star Bulk (NASDAQ: SBLK), Eagle Bulk (NASDAQ: EGLE) and Scorpio Tankers (NYSE: STNG), which are almost entirely spot-exposed and have scrubber coverage of 97%, 90% and 76%, respectively.

On the other end are companies like Frontline (NYSE: FRO), Safe Bulkers (NYSE: SB) and International Seaways (NYSE: INSW), with scrubber coverage of 48%, 37% and 20%, respectively. Safe Bulkers also has lower spot exposure, at 77%, with 23% time-charter coverage (under a time charter, the charterer pays for fuel, not the owner). While these companies would still benefit from a wide HSFO-VLSFO spread if spot rates rise, public companies on the other end of the spectrum — with higher scrubber coverage — would benefit more.

Click for more articles by Greg Miller

Related articles:

- How invasion of Ukraine could ease shipping logjam off US ports

- Shipping isn’t waiting for sanctions. It’s refusing to move Russian cargo

- Shipping braces for impact as Russia-Ukraine crisis intensifies

- Price of ship fuel surging, poised to eclipse all-time high

- Ship fuel price highest since 2013, ‘scrubber spread’ widens

- Yet another worry: Price of ship fuel is now highest since 2014

- What $70+ oil means to container, tanker and dry bulk shipping

- Ship prices jump, spread widens. Scrubber revival nigh?

- How IMO 2020 turned into the Y2K of ocean shipping