Greetings,

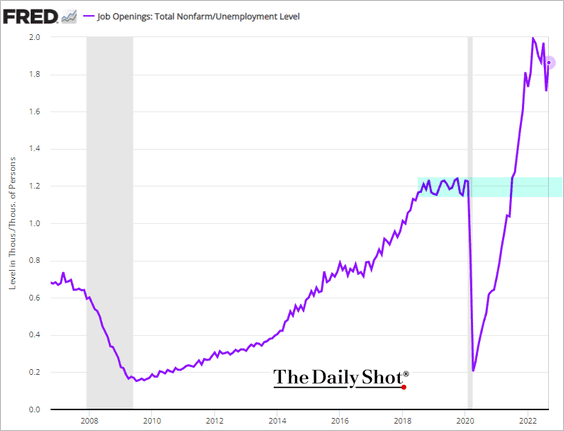

The United States: The Fed would like to see the job openings-to-unemployment ratio closer to pre-COVID levels, but it’s not budging for now. This does not look like a signal to “pivot”.

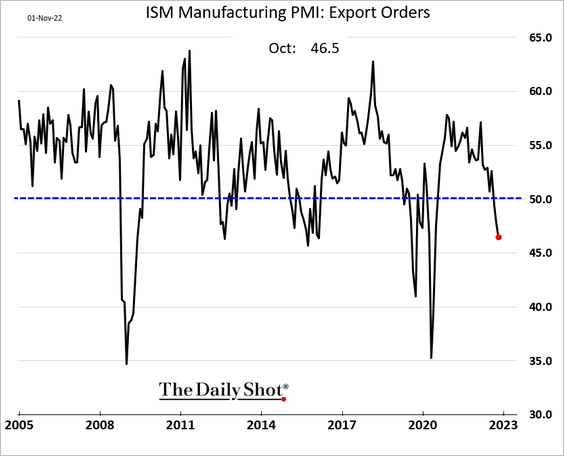

The decline in export orders accelerated, partially driven by the US dollar strength.

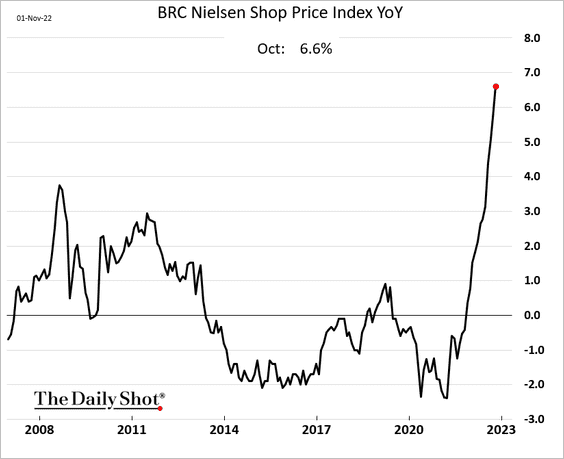

The United Kingdom: Prices charged by shops continue to surge.

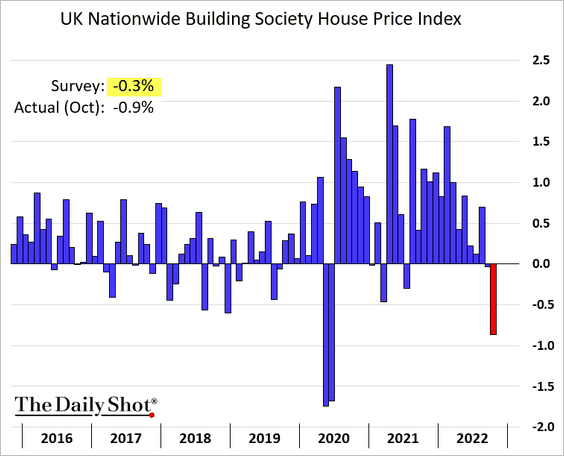

Also, home prices tumbled in October.

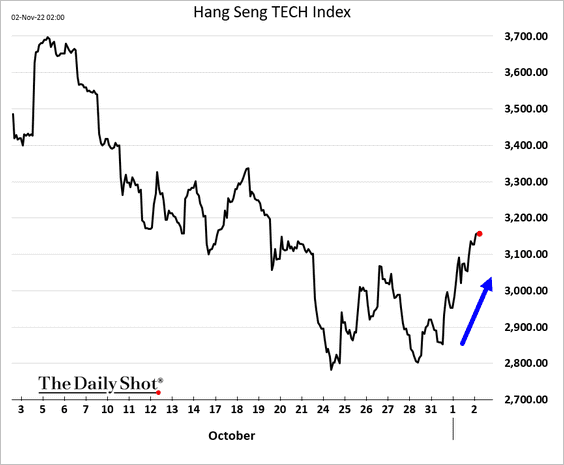

China: Stocks are rising on rumors of reopening plans.

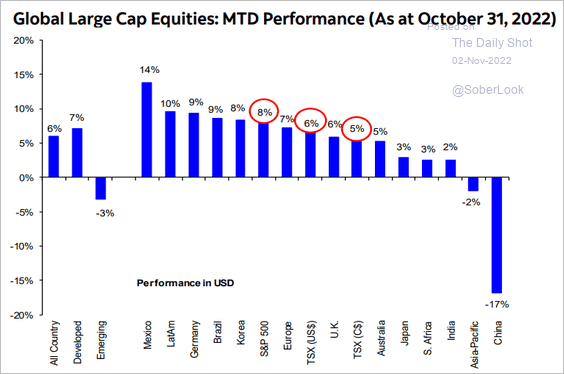

Equities: This chart shows large-cap performance in October across global markets.

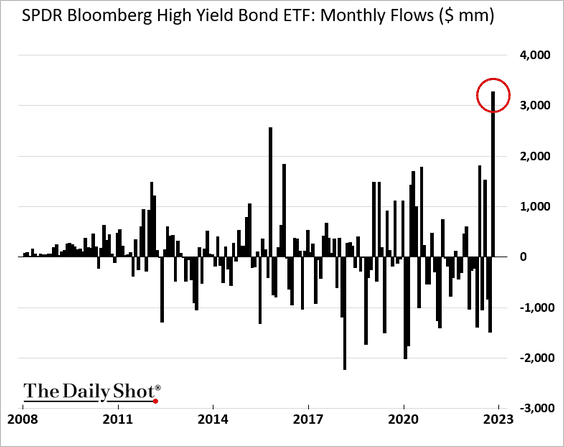

Credit: High-yield ETFs got some inflows last month.

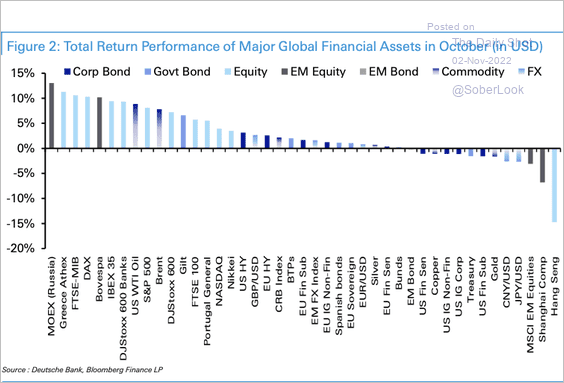

Global Developments: Here is a look at major asset class returns in October, led by Russian and European equities.

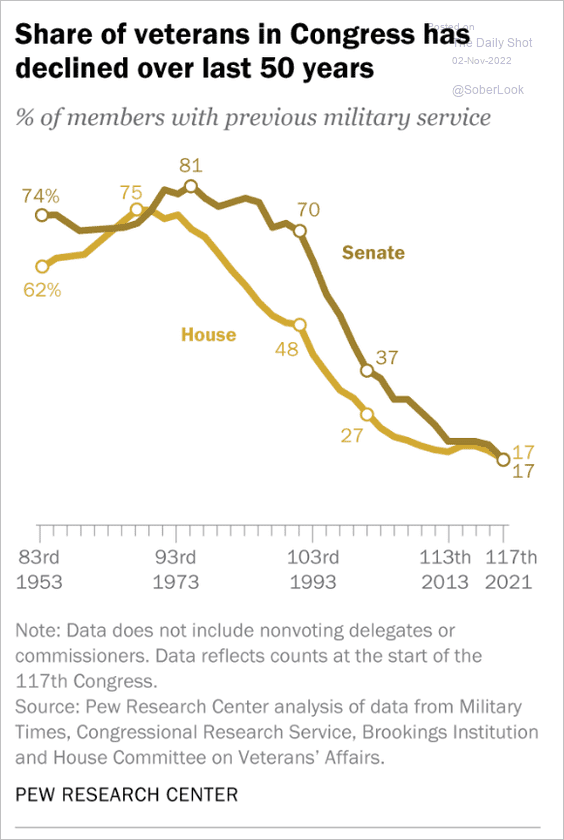

Food for Thought: Lastly, here’s a look at the share of military veterans in Congress.

Edited by Alexander Bowers

Contact the Daily Shot Editor: Brief@DailyShotResearch.com