Health Insurance 101: Selecting the Right Plan For Managing Type 2 Diabetes

Health insurance can be a headache, especially when selecting a plan that will cover the supplies and services you need to thrive with diabetes.

In this guide, we share four steps for choosing the right health insurance plan to help you manage your type 2 diabetes, whether you are being offered health insurance through your employer or are purchasing a plan independently from the health insurance marketplace.

Step 1: Stay on top of health insurance enrollment deadlines

Timing is critical when selecting a health insurance plan (and dealing with insurance in general). If you are offered health insurance through your employer, ask your human resources (HR) team about open enrollment dates—typically the last few months of the year.

If you recently started a new job, you usually have 30 days from your start date to enroll in the health insurance plan provided by your employer. If you do not enroll within this time frame, you risk having to wait until the next open enrollment period and not having insurance until then.

The annual open enrollment period for Medicare (for those age 65+ or those living with other qualifying health conditions) is October 15 through December 7. You can apply anytime for the Children’s Health Insurance Program (CHIP) or Medicaid (for eligible low-income adults, children, pregnant women, elderly adults and people with disabilities).

For all other adults and families purchasing other health insurance marketplace coverage (like through Healthcare.gov), open enrollment is typically from November 1 through December 31. The exact dates may vary slightly from state to state. You may qualify for a special enrollment period based on your estimated household income or if you have a qualifying life event such as losing your employer-provided health insurance coverage, getting married, or having a baby.

Step 2: Understand the costs associated with your plan

Understanding the costs that come with your health insurance plan is crucial. Typically, an employer will provide resources on the cost breakdown of their various insurance plan options but for the health insurance marketplace, doing a little research goes a long way.

Costs associated with insurance plans typically have to do with two things:

- Your monthly premium—the monthly fee you pay to have health insurance.

- Out-of-pocket expenses (like co-pays, co-insurance and deductibles)—costs not covered in full by your health insurance coverage. These costs are usually less than what you would pay out of pocket without insurance, but you may need to apply for special coverage for specific needs.

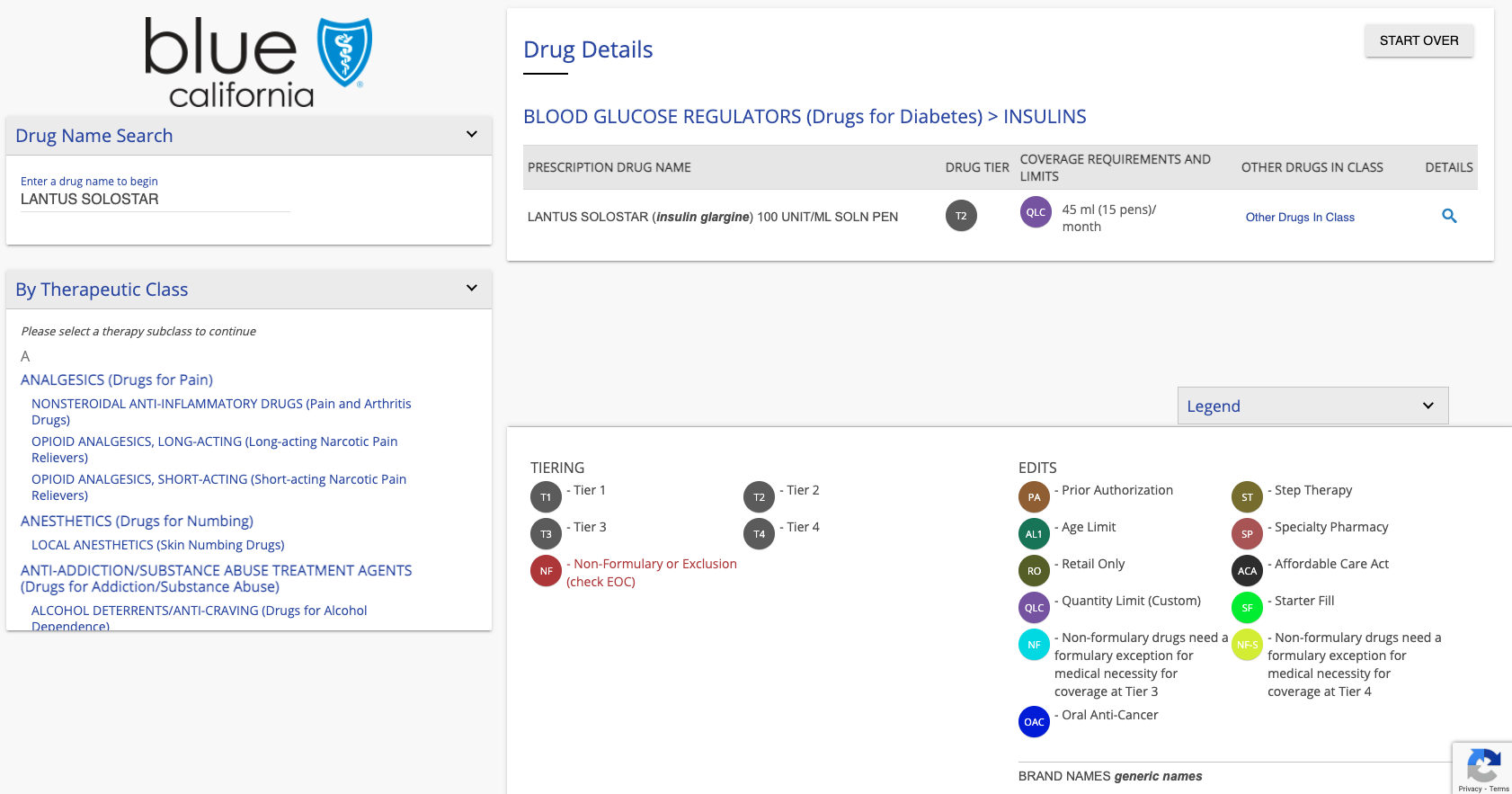

Here is an example of how your health insurance portal may look when you are using its drug formulary search engine to determine medication coverage:

By clearly understanding what different medical supplies, services and medications will cost you with your coverage, you may reduce the number of surprise bills you get throughout the year. To find out what different medical supplies, services and medications will cost you, lean on your health insurance website or a representative from your health insurance for support.

Don’t be afraid to call customer service, or start a live chat on your health insurance website if it’s offered, when you have questions! There is usually a portal on your health insurance website where you can explore your benefits, use a search tool that tells you what certain medications will cost at the pharmacy and more.

Your employee benefits representative or human resources department at your company may also help to shed a light on any questions like this that may come up with your health insurance.

If your employer has offered you information about the different health insurance plans available to you, lay them down side by side to compare numbers and benefits. If you are exploring health insurance through the open marketplace, you will also be able to compare them side by side on a computer screen before moving forward with anything.

Step 3: Determine what’s most important for you to have in a plan

When choosing a health plan, ask yourself the following:

Monthly costs:

- Would you prefer to pay a set monthly amount (monthly premium) and less when you see the doctor (co-pays, co-insurance, or deductible)?

- OR—Would you prefer to pay less of a set amount each month and more when you need to see the doctor?

Doctor visits:

- How often will you need to see a doctor? (People with diabetes may have to see more specialists, which may have higher co-pay costs.)

Provider changes:

- Will your current medical team (PCP, endocrinologist, mental health care provider, etc.) be covered, or will you need to find new providers?

Family planning + coverage:

- Do you have other family members that will be on the plan? Is it better to have separate individual plans rather than a family plan?

- Are any of your family members able to get lower-cost coverage through an employer?

Diabetes + subsidy programs:

- Does the health plan include any diabetes management programs? (It is becoming more common for health insurance plans to have special incentives or lower-cost programs for those who often check their blood sugar levels, commit to stopping smoking, sign up for weight management programs, etc.)

- Do you qualify for any health insurance monthly premium subsidy programs? (You can find out by entering your information on Healthcare.gov—subsidies are typically based on income, but more people qualify than you may think!)

Step 4: Consider other essential factors related to insurance

Just when you think you’ve asked all the right questions, there are still other health insurance-related factors to keep in mind! When dealing with health insurance selection, be sure to consider the following:

- Understanding the difference between in and out of network: you’ll pay more for providers out of network.

- If your plan offers a health savings account (HSA) or flexible spending account (FSA): these might save you tax dollars.

- If you can easily submit an appeal: appeals can be tricky, but they are commonly successful. (We elaborate on the appeal process in other health insurance-related content.)

- Does a health insurance plan appear too good to be true? Trust your gut. If it feels too good to be true, it probably is. Unfortunately, health insurance marketplace scams do exist! For example, if you are offered a short-term, lower premium plan upfront, it may not cover essential medications and services.

By addressing the above-mentioned, you can help ensure you select the right health insurance plan to meet your short and long-term medical needs while managing type 2 diabetes.

Lean on Beyond Type 2 health insurance resources to strengthen your understanding of the health insurance marketplace, get answers to FAQs and learn more about how you can optimize your health insurance plan to thrive with diabetes.

Editor’s note: Information in this resource is derived from a health insurance guide originally created by JDRF, an active partner of Beyond Type 1 at the time of publication. It has been edited to suit the needs of the type 2 diabetes community.