Life is a series of trade-offs.

Most of the decisions you make come with imperfect information.

Sometimes you make a dumb decision that works out perfectly.

Sometimes you make an intelligent decision that works out terribly.

There’s more luck involved in success and failure than many people are willing to admit.

So it goes.

That’s not to say you have no control over how things play out. Making good decisions over and over again can increase your odds of getting lucky.

I’ve made plenty of decisions I regret over the years. Who hasn’t?

But as I grow older I try to view my financial decisions through the lens of how my future self will view them.

Will I regret this decision in 5 years? 10 years? 20 years?

Here is a sample of some financial moves I won’t regret in the coming decades:

Paying for a nice vacation. I know how compound interest works. Every $1,000 you save for 3 decades is worth just over $10,000 at an 8% rate of return.

Compounding is a powerful force.

But you can’t let these numbers rule your life.

Once you reach a reasonable level of savings or hit your savings rate target you also have to enjoy yourself.

I’ll never regret paying for a vacation with my family.

First of all, you get the anticipation ahead of time. After the fact, you get memories you can look back on for years and years.

Memories provide their own form of compound interest.

Ignoring my portfolio balance during a correction. I never check the balance of my investment accounts when markets are falling.

I have an idea of what the values are because I follow this stuff so closely but I don’t put myself through the pain of looking at the actual numbers.

The less you look the less it hurts.

As long as you have a plan and some rules in place to guide your actions what’s the point of looking all the time?

If you only look when markets are rising and ignore your portfolio when it’s falling you can save yourself a lot of unnecessary anguish.

Sticking with my cable bundle. Totally worth that monthly payment for all of the TV and movies I watch. You can pry my cable bundle from my cold, dead hands.

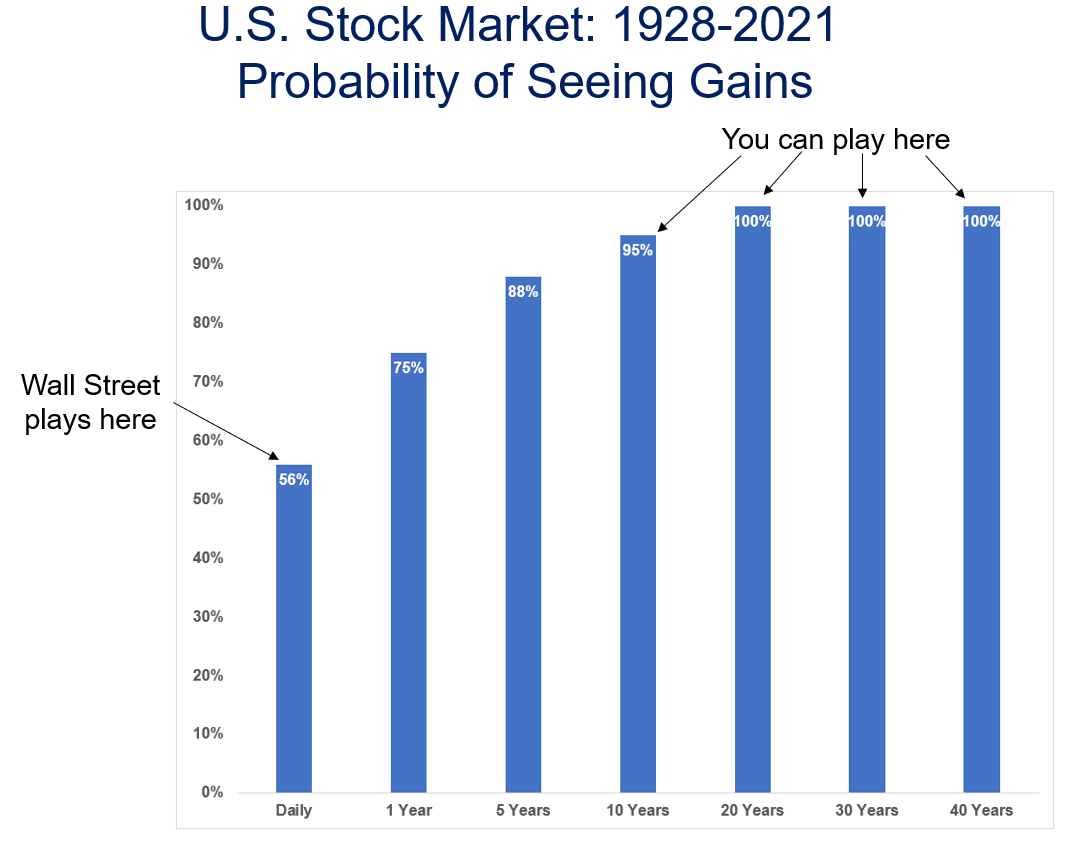

Buying stocks during a bear market. I bought some stocks this week in my brokerage account. I’ll buy some more next week in my 401(k) when I get paid.

Then I’ll buy some more stocks for my Liftoff account because that’s what happens on the 15th of every month. I’ll buy stocks again a few days later for my Vanguard SEP IRA because I do that every month too.

Sure, when the stock market falls it’s not much fun. When stocks go down it always feels like they’re going to go down a lot more and never stop falling.

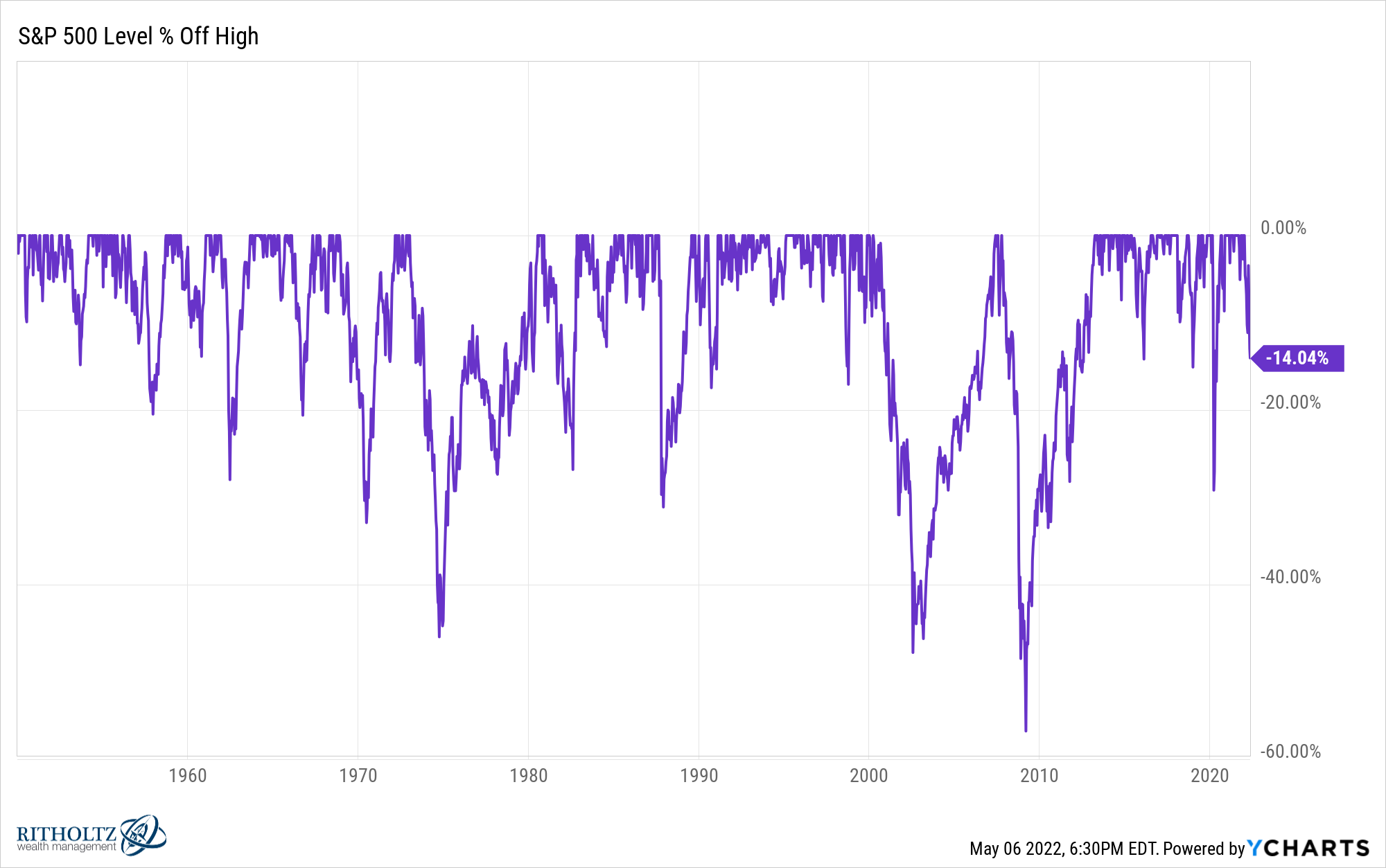

Just look at all of those corrections, bear markets and crashes over the years:

Every single one of them was filled with nerves, bad news and scary headlines.

Things eventually get better.

I know stocks could fall even further from here. Things could always get worse.

But I’m not going to look back at this correction in 20 years and regret buying stocks a little early.

Stocks are on sale.

I’m always a buyer when that happens.

Now here are some things I would regret in the years ahead:

Giving up on my investment plan just because stocks and bonds are down. Sometimes investing is uncomfortable. That doesn’t mean you throw your investment plan out the window.

You can’t expect everything to go up al the time.

Obsessing over my portfolio every time markets fall. What good does it do to spend all of your time worrying about something that’s completely out of your control?

If you build corrections and crashes into your expectations they don’t sting quite as bad.

I know my portfolio is going to go down on occasion. Sometimes certain investments will get vaporized.

That’s how risk works.

Not nailing the exact bottom of the correction. The only people who buy at the very bottom are lucky or lying.

My financial plan isn’t predicated on timing the market perfectly.

Sometimes I buy when stocks are high and they go higher. Sometimes I buy high and they go lower. Sometimes I buy when they’re low and they go lower. And so on and so forth.

That’s the beauty of buying periodically — no single purchase will seal your fate.

If your investment plan requires perfection you’re going to be disappointed on a regular basis.

You don’t have to regret losses in the stock market if you expect them to happen in advance.

Further Reading:

Sometimes You Just Have to Eat Your Losses in the Markets