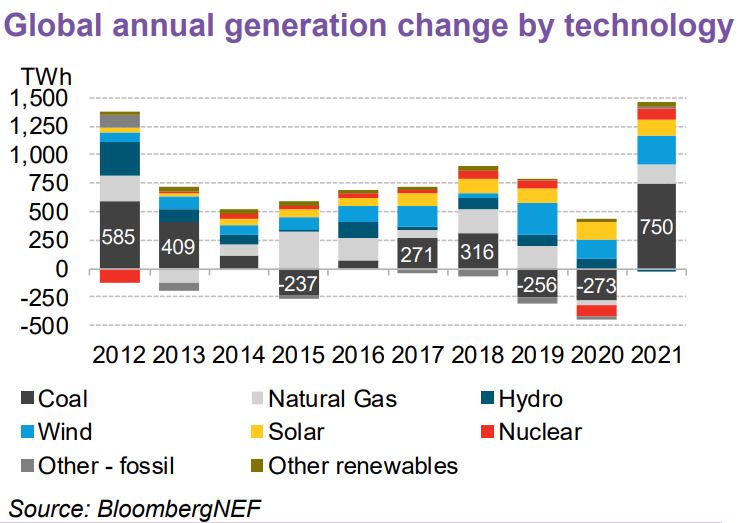

The world recorded an unprecedented spike in coal generation in 2021 as countries turned to existing fleets of fossil-fueled power plants to meet fast-growing power demand and keep the lights on amid droughts and higher natural gas prices. However, renewable technologies also had a banner year, both in terms of contributions to global generation and new capacity added.

Download the complete report here.

What occurs over the balance of this decade stands to be decisive in determining whether the world achieves a net-zero emissions path and policy mechanisms to address today’s energy challenges will influence how that future unfolds. This annual report examines trends in global generation, capacity and emissions. It aims to illustrate to policy makers, investors and other key stakeholders, ahead of COP27, the state of the power sector globally through year-end 2021. It is based on data collected by BloombergNEF analysts on six continents from primary sources in 136 countries and markets, along with aggregated data from the rest of the world. Key findings include:

- The world saw an unprecedented spike in global coal generation 2020-2021, with an 8.5% jump in power production from the technology. Greater coal use boosted power sector CO2 emissions 7% in 2021 from the year prior.

- Three factors contributed to the coal surge: rebounding top-line electricity demand thanks to economic recovery, lower hydro generation due to droughts around the world and higher natural gas prices. Half of the countries that pledged at the COP26 talks to phase out coal recorded growth in coal generation in 2021.

- Led by Asia, total global power production jumped 5.6% in 2021 as economies bounced back from the impacts of Covid-19. Power generation spiked to 27,300TWh from 25,800TWh to set a new high following three years of stable electricity demand.

- Solar achieved a new milestone in 2021, clearing 1,000TWh of generation for the first time, while wind neared 2,000TWh. Together, the technologies accounted for 10.5% of all power produced worldwide. In all, zero-carbon generation totaled over 10,000TWh to meet nearly 40% of global power demand.

- Wind and solar accounted for three quarters of the 364GW of new capacity installed in 2021. Solar alone was half of all capacity added and solar annual build was 25% higher in 2021 than in 2020. Meanwhile, net growth in coal capacity was at its lowest in at least 15 years. In all, fossil fuels accounted for only 14% of total capacity added in the year.

- More countries than ever are opting to build renewable energy. In 2021, over three quarters of the world’s nations surveyed installed more clean power (including hydro) on a capacity basis than any other technology. Solar was the technology of choice in nearly half of the world’s nations. Hydro followed with 15%, down from 20% a decade earlier.

- Solar is also quickly spreading to new markets though deployment at scale remains somewhat concentrated. In 2021, the number of countries that installed at least 1MW of solar capacity reached a new high of 112 markets – 7.5 times the number of markets that added coal. This is up from 101 markets in 2020 and just 55 in 2012.

- 53 economies added some wind capacity in 2021, up from 44 in 2020. Still, clean energy deployment at scale remains concentrated. Ten markets accounted for 85% of solar capacity added. A separate 10 were where 89% of 2021 wind got built.

- Total global power-generating capacity has nearly doubled over 15 years and reached a new high at 7.9TW in 2021. The Asia-Pacific region has led the capacity boom with 191% growth 2006-2021. Coal continues to account for over a quarter of the global installed capacity.