The independent source for health policy research, polling, and news.

Poll: Ahead of House Tax Reform Vote, Americans are More Likely to Rank Children’s Health Care, Hurricane Relief and Other Issues as Top Priorities for Washington

Controlling Immigration Tops Republicans’ Priority List, With Tax Reform among a Number of Second-Tier Issues Including Hurricane Relief and ACA Repeal

Contacts

Most of the Public Initially Favors Getting Rid of the ACA’s Individual Mandate As Part of Tax Reform, But Some Become Opponents When Presented with Facts and Arguments for Keeping the Mandate

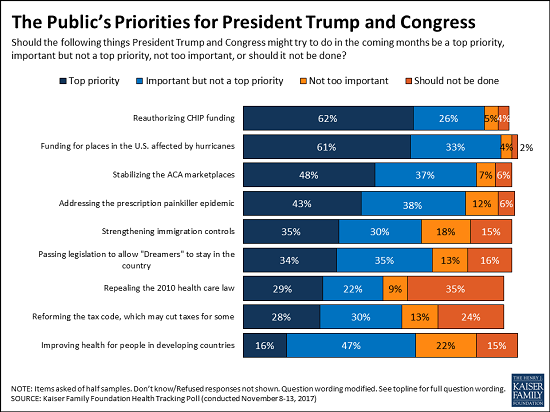

As the House prepares to vote Thursday on its tax reform bill, a new Kaiser Family Foundation poll finds almost three in 10 Americans (28%) view tax reform as a top priority for President Trump and Congress.

That’s significantly fewer than the share that say the same about reauthorizing funding for the Children’s Health Insurance

Program (62%), hurricane recovery funding (61%), stabilizing the Affordable Care Act’s insurance marketplaces (48%) and addressing the prescription painkiller epidemic (43%). Two immigration-related issues – strengthening controls to limit who enters the country (35%) and passing legislation to allow the Dreamers to legally stay (34%) – also rank higher, while a similar share (29%) say repealing the Affordable Care Act is a top priority.

Among Republicans, half (51%) say reforming the tax code is a top Washington priority, behind strengthening immigration controls (69%) but similar to the share who consider hurricane recovery funding (52%), repealing the Affordable Care Act (50%), stabilizing the insurance marketplaces (46%) and reauthorizing CHIP funding (46%) to be top priorities.

In a tweet Monday, President Trump called on Congress to end the Affordable Care Act’s individual mandate, which requires most Americans to have health insurance or pay a tax penalty and has long been the least popular provision in the law. While the House tax reform bill does not currently address the mandate, key Republican senators said Tuesday that they will include such a provision in their version of the bill.

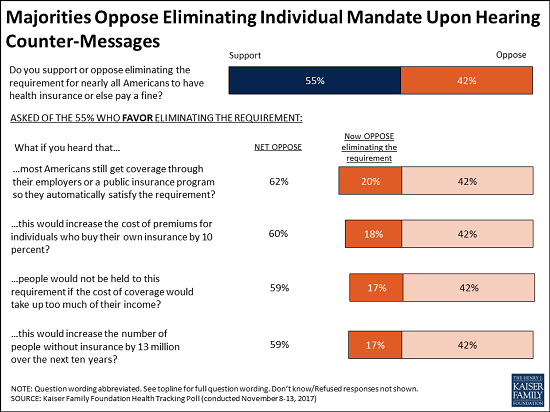

The new poll finds that most Americans (55%) initially support eliminating the mandate as part of tax reform, while four in 10 (42%) oppose it. Most Republicans (73%) and independents (58%) support ending the mandate, while most Democrats (59%) oppose it.

These views are malleable, with about a third of supporters (representing a fifth of the public overall) switching to oppose the mandate’s repeal when presented with facts and arguments about who is impacted and potential consequences of its repeal.

For example, the share who oppose eliminating the mandate can rise as high as 62 percent when initial supporters hear that most Americans get coverage through their employers or government programs that meets the mandate’s requirements. Similar majorities ultimately oppose eliminating the mandate when presented with other arguments against it, including that premiums for people who buy their own health insurance would go up, that people are exempted from the mandate if the cost of coverage takes up too much of their income and that getting rid of the mandate would result in 13 million more people being uninsured over the next 10 years, as the Congressional Budget Office has estimated.

One provision in the House bill would eliminate a tax deduction that allows people with high medical costs to deduct any medical and dental expenses that exceed 10 percent of their income. A majority (68%) of the public – including majorities of Democrats (77%), independents (66%), and Republicans (61%) oppose eliminating the tax deduction for individuals who have high health care costs.

More than four in 10 (44%) of the public think eliminating the deduction for high medical costs will affect them and their families, though in reality a much smaller share of the public uses that deduction in any given tax year. According to the Internal Revenue Service, about 17 percent of taxpayers who file itemized deductions use this deduction (approximately 6% of all taxpayers and 3% of the public).

Looking ahead to the 2018 midterm elections, the public is divided over whether not passing a tax reform plan or not repealing the ACA would be a bigger deal for President Trump and Republicans. Nearly half of the public say it will be a bigger problem if the president and Republicans are unable to pass their tax reform plan (47%), similar to the share who say it will be a bigger problem if they are unable to revive a repeal of the ACA (44%). Republicans are also divided, with similar shares saying it would be a bigger deal if President Trump and Republicans are unable to repeal the ACA (50%) and if they are unable to pass tax reform (45%).

METHODOLOGY

Designed and analyzed by public opinion researchers at the Kaiser Family Foundation, the poll was conducted from November 8 – 13, 2017 among a nationally representative random digit dial telephone sample of 1,201 adults. Interviews were conducted in English and Spanish by landline (415) and cell phone (786). The margin of sampling error is plus or minus 3 percentage points for the full sample. For results based on subgroups, the margin of sampling error may be higher.